Tax treaties play a critical role in helping pension funds avoid double taxation and secure tax advantages. These agreements determine how income is taxed between the country where it’s earned (source country) and where the taxpayer resides (residence country). For pension funds, treaties often offer reduced withholding tax rates, defer taxes on earnings until distribution, and clarify taxing rights for different types of pensions, such as private pensions, government pensions, and social security.

Key Points:

- Withholding Tax Reductions: Many treaties lower or eliminate withholding taxes on pension payments. For instance, the U.S.-Canada treaty caps withholding at 15% for U.S. residents receiving Canadian pensions.

- Tax Deferrals: Earnings within pension funds often remain untaxed until distributed, as seen in treaties with countries like Belgium and the U.K.

- Source vs. Residence Taxation: Most pensions are taxed in the recipient’s residence country, while government pensions are taxed in the source country.

- Foreign Tax Credits: When both countries tax the same income, treaties allow the residence country to provide credits for taxes paid to the source country.

- Compliance Requirements: Eligibility for treaty benefits requires meeting residency and beneficial ownership rules, along with proper documentation like Form 8802 or Form 8833 in the U.S.

Navigating these treaties ensures pension funds maintain their tax-advantaged status while complying with international tax laws. Proper planning and documentation are essential for avoiding penalties and optimizing tax outcomes.

51. What To Do With Your UK Pensions Once You Settle In The US: Maximise The Potential

sbb-itb-9792f40

Main Tax Treaty Clauses Affecting Pension Funds

Tax Treaty Rules for Different Pension Types: Who Taxes What

Withholding Tax Rates on Pension Payments

Tax treaties often work to reduce or completely remove withholding taxes on pension payments. Without these agreements, withholding tax rates can be steep. For instance, Canada applies a standard 25% withholding tax under Part XIII of its Income Tax Act. However, treaties frequently lower these rates or even eliminate them for qualifying individuals.

Take the U.S.-Canada Tax Convention as an example: it caps withholding taxes on periodic pension payments to U.S. residents at 15%. Some treaties go a step further, offering full exemptions when annual pension payments fall below specific thresholds. The exact rate depends on the terms of the treaty and the recipient’s eligibility.

Government pensions and social security payments are treated differently. These payments are generally taxed only by the country that issues them. For example, a U.S. citizen receiving Social Security benefits abroad won’t typically face foreign taxes on those payments, though U.S. tax requirements still apply.

Next, let’s look at how treaties address income exemptions for pension fund earnings. Modern AI hedge fund administration tools can also help track these complex cross-border exemptions.

Income Exemptions for Pension Funds

Many tax treaties ensure that pension fund earnings remain untaxed until distributed. For instance, agreements with countries like Belgium, Bulgaria, Iceland, Malta, and the United Kingdom specify that investment income stays tax-free as long as it remains within the fund.

The U.S.-Germany treaty provides additional benefits under Article 18A. U.S. residents working in Germany can deduct contributions to German pension plans from their U.S. taxable income. Employer contributions to these plans are also excluded from U.S. income, as long as the employment income is taxable in Germany and the contributions fall within prescribed limits.

For Canadian pensions, U.S. citizens can defer U.S. taxes on accrued income under Article XVIII, following guidelines outlined in Rev. Proc. 2014-55.

With income exemptions covered, it’s important to understand how treaties allocate taxing rights between source and residence countries.

Source vs. Residence Taxation Rules

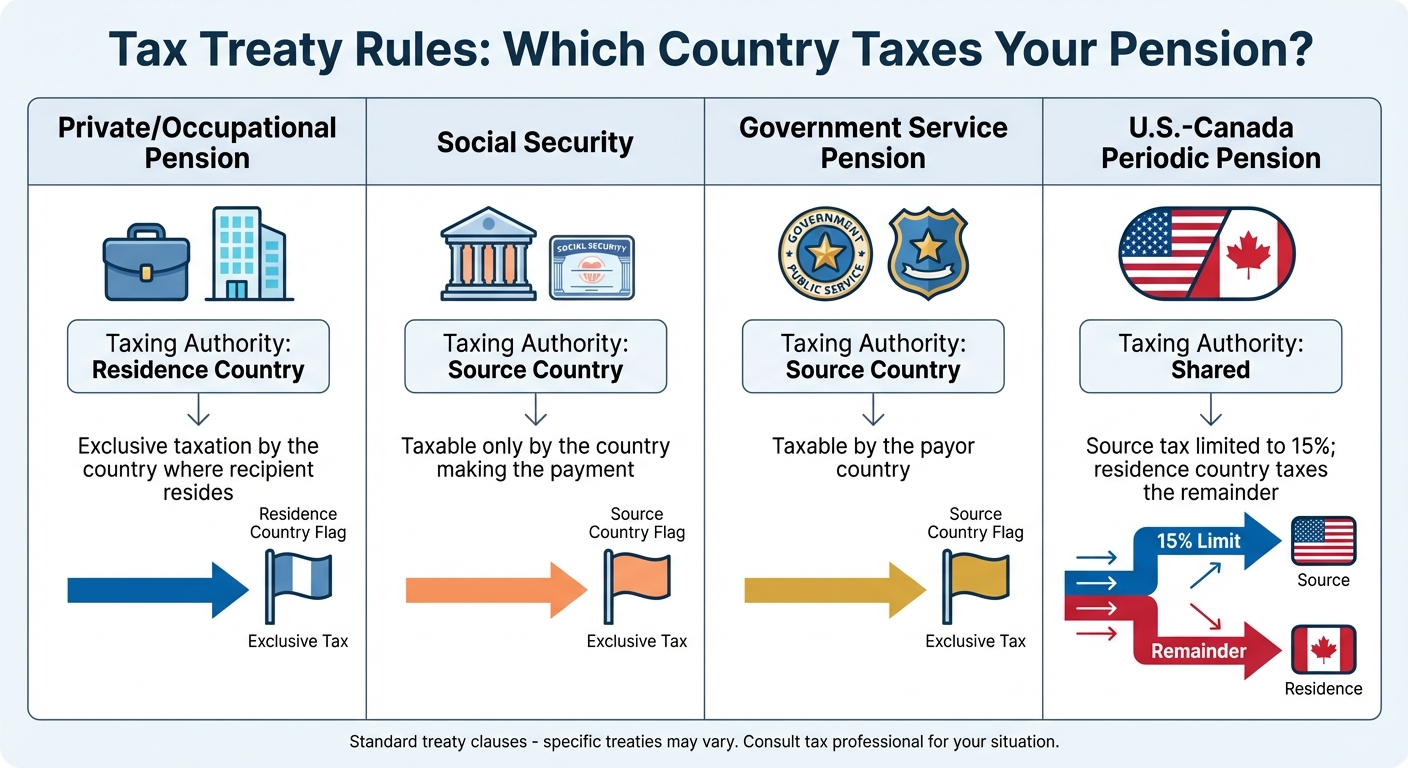

Tax treaties also clarify which country has the right to tax pension income. Generally, most treaties follow a residence-based taxation rule, meaning pensions are taxed only in the country where the recipient resides.

However, government pensions are an exception. These are usually taxed by the source country – the one making the payments. Private occupational pensions typically remain under the residence country’s jurisdiction.

Some treaties allow for shared taxation. For example, under the U.S.-Canada treaty, Canada can impose a withholding tax of up to 15%, while the U.S. taxes the full amount but provides a credit for Canadian taxes paid. In contrast, the U.S.-France treaty specifies that pension payments are only taxable in the country of origin, exempting them from taxation in the recipient’s residence country.

| Pension Type | Taxing Authority | Standard Clause |

|---|---|---|

| Private/Occupational Pension | Residence Country | Exclusive taxation by the country of residence |

| Social Security | Source Country | Taxable only by the country making the payment |

| Government Service Pension | Source Country | Taxable by the payor country |

| U.S.-Canada Periodic Pension | Shared | Source tax limited to 15%; residence country taxes the remainder |

How Tax Treaties Prevent Double Taxation

Foreign Tax Credits

When both the source country and the residence country have the authority to tax pension income, tax treaties often rely on foreign tax credits to avoid double taxation. Essentially, the residence country provides a credit for taxes already paid to the source country, reducing the taxpayer’s domestic liability.

Take the Canada–U.S. Tax Convention as an example. Canada may impose a withholding tax of up to 15% on periodic pension payments made to U.S. residents. The United States, in turn, includes the entire pension amount in taxable income but offsets this by granting a credit for the taxes paid to Canada. This approach ensures that individuals are not taxed twice on the same income.

Many treaties incorporate provisions – frequently based on Article XXIV – that allow the residence country to deduct foreign taxes from its own tax liability, effectively eliminating double taxation.

Beyond foreign tax credits, some treaties also address the timing of taxation, which we’ll explore next.

Tax Deferrals and Recognized Arrangements

A common feature in many tax treaties is the deferral of taxation on pension fund earnings until distributions are received. This prevents the residence country from taxing the internal growth of a foreign pension fund prematurely.

The U.S.–Belgium Income Tax Treaty illustrates this well. Article 17 of the treaty defers taxation on the earnings of a U.S.-qualified plan until distributions are made, while Article 1(4)(a) specifically exempts this benefit from the saving clause.

In addition, some treaties allow contributions to foreign pension plans to be deducted from taxable income. For instance, under Article 18A of the U.S.–Germany Income Tax Treaty, a U.S. citizen working in Germany can deduct contributions made to German pension plans for U.S. tax purposes. Similarly, employer contributions to these plans are not treated as taxable income in the United States.

"A number of tax treaties permit U.S. beneficiaries of foreign pension plans to defer or delay U.S. income tax liability in connection with a foreign pension until such time distributions are paid." – Anthony Diosdi, Tax Attorney, Diosdi & Liu, LLP

These provisions help maintain the tax-advantaged nature of pension funds, ensuring that investment growth isn’t taxed before benefits are distributed.

Compliance Requirements and Best Practices

Meeting Treaty Eligibility Requirements

Pension funds must adhere to specific criteria to qualify for treaty benefits. The first step is establishing tax residency, which is defined under Article 4 based on each country’s domestic laws. In cases where dual residency arises, treaties resolve the issue using tiebreaker rules in a specific order: permanent home, center of personal and economic relations, habitual abode, and nationality.

Another key factor is beneficial ownership, which ensures the pension fund is the actual owner of the income, not merely a pass-through entity. For cross-border tax relief, the host country’s Competent Authority must verify that the foreign pension plan corresponds to a domestic registered plan. Additionally, individuals often need to demonstrate regular contributions to the plan before starting services in the host country. For instance, under some Canadian tax treaties, eligible foreign pension deductions are limited to a service period of 60 months.

Meeting these requirements is only the beginning. Proper documentation and reporting are equally important to secure treaty benefits.

Documentation and Reporting Requirements

After confirming eligibility, meticulous documentation becomes crucial. Proper paperwork ensures treaty claims are processed successfully. Pension funds must obtain formal residency certificates, such as filing Form 8802 in the U.S. to receive Form 6166, and include Form 8833 when claiming a treaty position that deviates from domestic tax laws.

Employers are responsible for reporting pension adjustments on official tax statements, like the T4 slip in Canada. If employers fail to do so, individual participants must report these amounts on their own tax returns. To streamline the process, the Canadian Revenue Agency provides pre-approved lists of qualifying plans for several countries, including Chile, Estonia, Finland, France, Germany, Ireland, and Latvia. Reviewing these lists before filing can save time and reduce the risk of rejection. Additionally, ensuring that the foreign plan is registered with its home country’s regulatory body – such as Ireland’s Pensions Board – helps meet the "exempt approved scheme" criteria required by many treaties.

Working with Fund Administration Services

Managing compliance efficiently means integrating all these requirements into smooth, reliable processes. Navigating the complexities of multi-jurisdictional tax rules often demands professional expertise. Fund administrators handle essential forms like W-8BEN, 8833, and 8802, which are critical for claiming treaty benefits. They also manage regulatory reporting obligations under FATCA, CRS, and FBAR.

Charter Group Fund Administration specializes in providing comprehensive compliance services tailored to offshore jurisdictions such as the Cayman Islands. Their advanced automation tools track deadlines, manage participant records, and calculate withholding amounts with precision. This reduces the risk of penalties from late or incorrect tax filings.

"Compliance is not only a legal mandate but also a cornerstone of fiscal responsibility for pension fund administrators." – Lizanne de Lange

Professional fund administrators also assist with intricate tasks like navigating "Limitation on Benefits" rules and verifying beneficial ownership, both of which are essential for reduced withholding rates. For pension funds dealing with complex assets such as cryptocurrency or operating across multiple jurisdictions, experienced administrators ensure treaty obligations are met consistently and accurately.

Conclusion

Tax treaty clauses play a crucial role in ensuring pension funds remain compliant while optimizing their performance. The United States has income tax treaties with about 60 countries, each containing provisions that directly influence net returns. For example, the 2019 amendment to the U.S.-Switzerland treaty reduced withholding on qualifying dividends from 15% to 0%, potentially saving up to $150,000 on a $1 million payment.

These treaties offer more than just lower withholding rates. Agreements with countries like the U.K., Belgium, and Canada allow for tax-deferred growth and cross-border contribution deductibility. This can translate into significant savings for employees working internationally when their home-country plans are recognized as "generally corresponding" schemes. However, the Saving Clause in Article 1 can limit these benefits for U.S. citizens unless specific exceptions are met. While the advantages are clear, they come with strict compliance and documentation requirements.

"Planning for income taxation of pension schemes when countries outside the United States are involved should include a review of all retirement plans and applicable tax treaties as well as taxpayers’ long-term retirement goals." – Kevin D. Anderson, CPA, J.D., Managing Director, BDO USA LLP

Challenges such as dual residency and protocol amendments can complicate matters further. For instance, highly compensated employees earning $130,000 or more may face immediate income inclusion or permanently lose treaty benefits if time-sensitive provisions are overlooked.

Effective pension fund management demands staying up-to-date with treaty protocols, ensuring accurate documentation, and applying tiebreaker rules correctly. From handling residency certificates to filing Form W-8BEN or navigating Competent Authority agreements, the technical requirements can be overwhelming. Professional fund administration support is often indispensable, particularly for funds operating offshore or managing intricate assets. Organizations seeking specialized assistance can explore the services provided by Charter Group Fund Administration.

FAQs

Which treaty clauses most affect pension fund withholding taxes?

Key treaty clauses influencing pension fund withholding taxes revolve around how pension or retirement benefits are defined, the classification of taxable income, and provisions for exemptions or reduced withholding rates. Many of these align with the OECD Model Tax Convention, particularly Article 10, which deals with dividends. To grasp their impact on pension funds, it’s crucial to examine clauses that address tax relief and how different types of income are categorized.

How do I prove I qualify for treaty pension benefits?

To access pension benefits under a tax treaty, you need to demonstrate that you meet the specific requirements outlined in the treaty. Generally, this means you must be a resident of the treaty country and confirm that the pension plan is acknowledged for tax purposes in that country. Additionally, the plan should primarily serve as a provider of retirement benefits and comply with the treaty’s definition of a pension fund or retirement plan.

When do foreign tax credits apply to pension income?

Foreign tax credits can be applied to pension income if you’ve paid or accrued taxes to a foreign country on that income and meet the requirements for claiming the credit. This credit is designed to reduce your U.S. tax liability, following the IRS guidelines for foreign tax credits.