Tax treaties are agreements between countries that reduce or eliminate withholding taxes on cross-border investments, helping pension funds keep more of their earnings. Without these treaties, pension funds face taxes on income like dividends and interest at rates as high as 30%, significantly cutting into returns. Here’s how tax treaties work for pension funds:

- Lower Withholding Taxes: Treaties often reduce withholding taxes on dividends, interest, and royalties to rates like 15%, 10%, or even 0%.

- Exemptions for Pension Funds: Many treaties include special provisions that exempt pension funds from withholding taxes entirely, provided they meet eligibility criteria.

- Foreign Tax Credits: If withholding taxes can’t be avoided, pension funds can claim credits in their home country to offset the taxes paid abroad.

- Required Documentation: Pension funds must file forms like W-8BEN-E or Form 6166 to claim treaty benefits and prove tax residency.

To maximize savings, pension funds should carefully follow documentation rules, stay updated on treaty changes, and ensure compliance with anti-abuse measures like Limitation on Benefits (LOB) clauses. Missing steps can result in full withholding rates and lengthy refund processes.

Key Tax Treaty Provisions for Pension Funds

When it comes to saving strategies, tax treaties play a significant role in reducing the tax burden on pension funds. These agreements often include provisions specifically designed to lower – or even eliminate – certain withholding taxes.

Exemptions from Withholding Tax on Dividends

Most tax treaties feature a "Dividends" article (commonly Article 10), which sets reduced withholding tax rates for residents of treaty countries. Standard rates can drop to 15%, 10%, or even less, depending on the treaty. For pension funds, many treaties go a step further, offering a "Pension Schemes" provision that exempts dividends entirely, provided the fund does not actively trade them.

To qualify, pension funds must meet Limitation on Benefits (LOB) requirements or secure approval from the relevant tax authority. To assist with planning, the IRS provides "Table 1" (Tax Rates on Income Other Than Personal Service Income), which outlines the specific withholding rates for dividends under each treaty.

Similar provisions often extend to other types of income, such as interest and royalties.

Reduced Rates on Interest and Royalties

Separate treaty articles address interest and royalties, offering reduced withholding tax rates – or complete exemptions – on income from foreign bonds, loans, or intellectual property. These benefits are typically reciprocal, meaning a U.S. pension fund investing abroad enjoys the same reductions as a foreign fund investing in the U.S.

Eligibility hinges on tax residency under Article 4, with tiebreaker rules applying in cases of dual residency. Pension funds must provide proper documentation to the withholding agent before payments are made to claim these benefits. Additionally, reviewing treaty protocols or amendments is essential, as these can update withholding rates and eligibility criteria.

When withholding tax reductions fall short, tax credits can provide further relief.

Tax Credits for Cross-Border Investments

If pension funds cannot fully avoid foreign withholding taxes, they may claim a Foreign Tax Credit (FTC) in their home country to offset those taxes against domestic liabilities. This prevents double taxation but comes with a caveat: funds cannot claim a credit for taxes withheld beyond the treaty-specified rate.

"A Foreign Tax Credit generally would not be permitted for tax withheld that is in excess of the liability under foreign law, taking into consideration applicable income tax treaties." – Internal Revenue Service

To maximize benefits, pension funds should apply for treaty-based reductions at the source. If denied, they can seek a refund from the foreign tax authority. Proving beneficial ownership of income is critical, as funds must show they are investing on their own behalf and include the income in their revenue calculations. Accurate residency documentation is also key, as some tax authorities require confirmation letters that are valid for only three years.

| Provision Type | Primary Function | Typical Treaty Article |

|---|---|---|

| Dividends Article | Reduces withholding rates for cross-border dividend payments | Article 10 |

| Pension Schemes Article | Offers exemptions or favorable treatment for pension fund income | Varies by treaty |

| Limitation on Benefits (LOB) | Prevents treaty shopping through residency and ownership tests | Article 22 or 28/29 |

| Interest & Royalties | Sets reduced withholding rates for debt and IP income | Articles 11 & 12 |

How to Claim Treaty Benefits

Step-by-Step Process for Pension Funds to Claim Tax Treaty Benefits

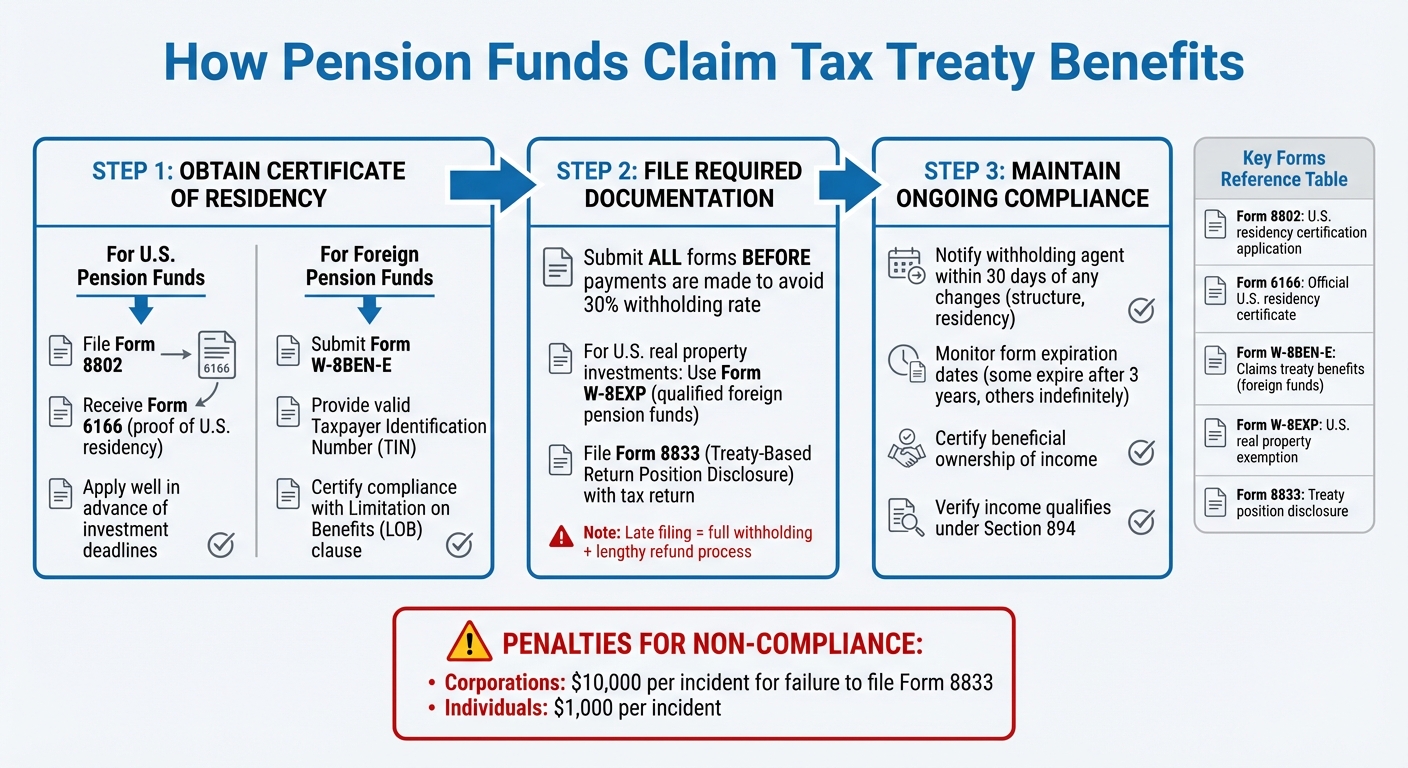

Claiming treaty benefits involves following strict guidelines for documentation and timing. Missing these steps can result in a full statutory withholding rate of 30%.

Obtaining a Certificate of Residency

To claim treaty benefits, pension funds must first establish their tax residency. U.S. pension funds need to file Form 8802 to obtain Form 6166, which serves as proof of U.S. residency. Foreign pension funds, on the other hand, must provide a Form W-8BEN-E (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting) along with a valid Taxpayer Identification Number (TIN) and certification under the Limitation on Benefits (LOB) clause. These requirements are designed to prevent misuse of treaties by third-country residents.

Foreign tax authorities often require this residency certificate when granting treaty relief. U.S. funds should apply for these documents well in advance of any investment deadlines to avoid delays.

For foreign pension funds earning U.S.-source income, it’s essential to establish both their foreign status and residency in their home country. This is done by submitting Form W-8BEN-E to the U.S. withholding agent. The form must include a valid TIN (either U.S. or foreign) and certify compliance with the treaty’s LOB provisions. Once residency is certified, the appropriate forms should be filed promptly to secure treaty benefits.

Filing Procedures for Treaty Relief

To avoid the full statutory withholding rate, all required documentation must be submitted before any payments are made. If the forms are filed after payment, the fund will face withholding at the full rate and will need to request a refund from the tax authority – a process that can be both lengthy and complicated.

For foreign pension funds investing in U.S. real property, a different form applies. Form W-8EXP is used by "qualified foreign pension funds" to claim exemption from withholding on the sale of U.S. real property interests under section 897(l). Some W-8EXP forms remain valid indefinitely, while others expire after three years, depending on the claimed status. It’s critical to monitor these expiration dates to maintain compliance.

Funds taking a treaty-based tax position must also file Form 8833 (Treaty-Based Return Position Disclosure) with their tax return. Failure to file this form when required can result in penalties: $1,000 for individuals and $10,000 for corporations per incident.

| Form Number | Purpose | Who Files It |

|---|---|---|

| Form 8802 | Application for U.S. residency certification | U.S. pension funds seeking foreign treaty benefits |

| Form 6166 | Official certificate of U.S. residency | Issued by IRS to U.S. pension funds |

| Form W-8BEN-E | Claims treaty benefits on U.S.-source income | Foreign pension funds |

| Form W-8EXP | Claims exemption on U.S. real property dispositions | Qualified foreign pension funds |

| Form 8833 | Discloses treaty-based tax return position | Any fund taking a position that modifies IRC provisions |

Meeting Compliance Requirements

Ongoing compliance is just as important as the initial filings. Pension funds must notify their withholding agent within 30 days of any changes to critical information, such as organizational structure or residency. A new form must be submitted promptly to maintain treaty benefits. Funds must also certify that they are the beneficial owner of the income and that they "derive" the income under Section 894, ensuring that the income is not treated as fiscally transparent in their home jurisdiction. This prevents conduit entities from improperly claiming treaty benefits.

Before filing, funds should carefully review the LOB article in the applicable treaty. Requirements often include minimum ownership percentages by residents of the treaty country. Since 2001, U.S. payors can no longer rely solely on a payee’s address of record; a valid Form W-8BEN or W-8BEN-E must be on file to grant treaty benefits. Additionally, while federal tax treaties are binding at the national level, some U.S. states do not honor these treaties for state income tax purposes. Pension funds should verify state tax laws separately to ensure full compliance.

US Tax Treaty Examples for Pension Funds

US-Canada Tax Treaty: Key Provisions

The US-Canada tax treaty offers specific benefits for pension funds operating across the two countries. According to Article IV, Paragraph 1(b)(i), pension trusts and organizations that exist solely to provide retirement or pension benefits are treated as "residents", ensuring they qualify for treaty protections without confusion.

To access these benefits, the pension organization must be exempt from income taxation in its home country due to its role in providing retirement benefits. This tax-exempt status is crucial, as it prevents commercial entities from posing as pension funds to unfairly claim treaty advantages. Eligible Canadian and US pension funds enjoy reduced withholding rates on cross-border dividends, a provision that sets a precedent for similar arrangements in other treaties.

US-UK Tax Treaty: Benefits for Pension Investments

The US-UK tax treaty provides significant relief for pension funds, including reduced withholding rates or even full exemptions on U.S.-source income such as dividends, interest, and royalties. However, to qualify for these benefits, pension funds must meet the treaty’s Limitation on Benefits (LOB) provisions. These provisions are designed to prevent treaty abuse by ensuring only legitimate UK residents can claim the benefits.

To claim treaty advantages, pension funds must file Form W-8BEN-E and adhere to the LOB provisions to confirm residency. For exact withholding rates and procedural details, the IRS provides helpful resources, including tables and Publication 515. These requirements highlight the importance of tailored documentation and strict compliance with treaty terms.

Understanding the US Model Tax Treaty

The US Model Tax Treaty, which has undergone updates in 1996, 2006, and 2016, serves as a framework for bilateral agreements. It generally assigns taxation of private pensions to the country of residence, while social security and government pensions are taxed at the source. Notably, Article 1 includes a "saving clause", which allows the US to tax its citizens and residents on their worldwide income, except in cases where specific exceptions are outlined. Modern treaties also feature a "Pension Schemes" article that provides cross-border relief, making it essential to review the accompanying Technical Explanation for a clear understanding of the provisions.

sbb-itb-9792f40

Limitations and Challenges of Tax Treaties

While tax treaties can provide considerable tax savings, certain clauses and administrative hurdles may limit their effectiveness.

The Saving Clause in US Tax Treaties

The saving clause, found in Article 1 of U.S. tax treaties, allows the U.S. to tax its citizens and residents on their worldwide income, even when a treaty might otherwise restrict taxation. For instance, if a treaty specifies that a pension should only be taxed in the recipient’s country of residence, the U.S. can still apply its taxation rules to U.S. citizens and residents.

Without exceptions to the saving clause, the U.S. taxes distributions from foreign pension plans, regardless of what a treaty might state. This also applies to foreign social security payments and government pensions, which may remain taxable in the U.S. despite treaty provisions that aim to limit taxation to the country making the payment.

To address this, it’s essential to review the specific treaty and its protocols for "exceptions to the saving clause." Some treaties explicitly exempt specific pension-related provisions, allowing U.S. residents to claim treaty benefits. Consulting the Technical Explanation that accompanies a treaty can clarify how the U.S. interprets terms like "pension" and how the saving clause applies. If the saving clause triggers U.S. taxation of a foreign pension, you may be able to use a Foreign Tax Credit to reduce double taxation.

These limitations often intersect with anti-abuse measures, which are discussed next.

Anti-Abuse Provisions in Tax Treaties

Modern tax treaties incorporate anti-abuse measures to prevent entities from exploiting treaty benefits unfairly. The Principal Purpose Test (PPT) allows tax authorities to deny benefits if avoiding taxation was a key purpose of an arrangement or transaction – such as lowering withholding rates. If it’s reasonable to conclude that tax avoidance was a significant motive, benefits can be denied.

The Limitation on Benefits (LOB) provisions use objective criteria, such as legal structure, ownership, and business activities, to ensure only qualified individuals or entities with strong ties to the treaty jurisdiction can claim benefits. These rules aim to block third parties from using intermediary entities to access treaty benefits they wouldn’t otherwise qualify for.

Recent proposals suggest increasing withholding rates for entities based in jurisdictions deemed discriminatory, potentially overriding treaty benefits for certain pension funds.

To defend against PPT challenges, pension funds should maintain detailed documentation showing that cross-border investments are driven by legitimate commercial or regulatory reasons – not tax avoidance. Monitoring the U.S. Treasury Secretary’s list of discriminatory jurisdictions can also help funds anticipate potential withholding rate changes.

With these anti-abuse measures in place, meeting procedural requirements becomes even more critical.

Meeting Complex Administrative Requirements

Claiming treaty benefits requires precise documentation, including completing Form W-8BEN-E with a valid Taxpayer Identification Number (TIN). Without a valid TIN, the form is typically invalid for claiming treaty benefits.

The process for claiming reduced withholding rates in foreign countries depends on the laws of those countries, which can vary widely. If a foreign withholding agent rejects a treaty claim, the fund may need to file directly with the foreign government or rely on a Foreign Tax Credit in the U.S..

Determining tax residency adds another layer of complexity. If a fund is considered a resident of two countries, it must navigate tiebreaker rules based on factors like permanent home and economic ties, or seek assistance from a Competent Authority. For entities, funds must certify that the income qualifies under Section 894, confirming the entity is not fiscally transparent.

These administrative demands highlight the importance of thorough preparation and compliance when leveraging tax treaties.

How to Maximize Savings Through Tax Treaties

Pension funds can unlock additional savings by carefully managing tax treaties. These agreements, while beneficial, are often complex and subject to frequent updates. To navigate these challenges effectively, engaging expert administrators and adopting a proactive approach is crucial.

Working with Fund Administrators

Experienced fund administrators play a vital role in simplifying the intricate processes involved in treaty claims. They handle the heavy lifting – complex documentation and compliance tasks – so pension funds can focus on their core objectives. For example, administrators adept at managing Competent Authority Arrangements can provide clarity on nuanced agreements.

One notable example is the U.S.-Switzerland Competent Authority Agreement, signed on December 5, 2024. This agreement introduced new refund procedures for U.S. Group Trusts and applied retroactively to dividends paid starting January 1, 2020. Skilled administrators can help identify such retroactive refund opportunities that might otherwise go unnoticed.

Take Charter Group Fund Administration, for instance. They offer services that go beyond treaty claims, including FATCA and CRS reporting. Their expertise ensures pension funds maintain the detailed records necessary for effective documentation and compliance.

Planning for Cross-Border Investments

Strategic planning is another key to maximizing returns on cross-border investments. Before committing capital, pension funds should perform a thorough treaty analysis. Resources like IRS Publication 901 and the Treasury’s Technical Explanations provide insights into how different jurisdictions handle pension income. Since treaty provisions are typically reciprocal, U.S. pension funds receiving income from treaty countries may qualify for tax credits, deductions, or reduced rates.

It’s also essential to verify compliance with the Limitation on Benefits article. Using the objective tests outlined in IRS Table 4 ensures that funds meet the necessary criteria before investing. This step helps avoid penalties and ensures treaty eligibility is confirmed before filing required disclosures.

Tracking Changes in Tax Treaties

Keeping up with treaty updates is equally important for maximizing savings. Tax treaties are revised frequently, and staying informed can make a significant difference. For example, the U.S.-Chile income tax treaty took effect for withholding taxes on February 1, 2024, while the U.S.-Hungary treaty was terminated on January 1, 2024. Additionally, the United States suspended key portions of its treaty with Russia (Articles 5-21 and 23) as of August 16, 2024.

Regularly reviewing IRS Publication 901 is an effective way to stay updated on treaty changes. It’s also important to consult both the original treaty and any Protocols – formal amendments that may revise specific articles – to ensure the correct version is applied to the relevant tax year. For the most accurate information, the Treasury’s "Treaties and Other International Documents" page serves as the authoritative source for current treaty texts.

Conclusion

Tax treaties provide pension funds with a practical way to minimize withholding taxes and avoid double taxation on international investments. These agreements often grant reduced rates or even full exemptions on dividends, interest, and royalties, which can significantly boost investment returns. Thanks to the reciprocal nature of most treaties, U.S. pension funds investing abroad can enjoy the same benefits – like credits, deductions, and exemptions – that foreign funds receive when investing in the United States. This framework highlights the importance of understanding compliance and procedural obligations.

That said, pension funds must adhere to residency and documentation rules to avoid costly penalties. Non-compliance can result in steep fines: corporations may face $10,000 for each failure to disclose a treaty-based position using Form 8833, while individuals risk penalties of $1,000.

Keeping up with treaty updates is just as important. For example, the upcoming U.S.-Chile tax treaty will take effect on February 1, 2024, while the U.S.-Russia treaty suspension begins on August 16, 2024. These changes illustrate how quickly the regulatory environment can evolve. As the IRS cautions, "You should use this publication only for quick reference. It is not a complete guide to all provisions of every income tax treaty". This dynamic landscape underscores the value of having knowledgeable guidance.

Partnering with experienced fund administrators, like Charter Group Fund Administration, can simplify the compliance process. These professionals handle testing, maintain essential records, and ensure that pension funds can efficiently apply treaty benefits – ultimately helping to maximize returns.

FAQs

How can tax treaties help pension funds reduce taxes?

Tax treaties offer substantial advantages to pension funds by lowering or completely removing withholding taxes on income such as dividends or interest from international investments. Many of these treaties classify pension funds as tax-exempt entities, enabling them to benefit from reduced tax rates or full exemptions.

Another key benefit is the prevention of double taxation. These agreements ensure that pension funds aren’t taxed on the same income in both the country where the income is generated and the fund’s home country. By utilizing these treaties, pension funds can enhance their investment returns, allowing them to dedicate more resources to their beneficiaries.

What documents do pension funds need to claim tax treaty benefits?

To access tax treaty benefits, pension funds must demonstrate they qualify as a recognized pension or retirement arrangement under the terms of the relevant treaty. This typically requires submitting specific forms or declarations to verify eligibility. In many cases, additional documentation, like certificates of residence or other treaty-mandated evidence, may also be necessary.

Ensuring all submitted documents are precise and adhere to IRS guidelines is crucial to prevent delays or complications during the process.

What challenges do pension funds face when using tax treaties?

Pension funds often encounter hurdles when trying to take advantage of tax treaties. A key obstacle comes from anti-treaty shopping provisions, such as the "Limitation on Benefits" (LOB) clause included in many agreements. These provisions aim to prevent misuse by requiring pension funds to satisfy specific criteria, like ownership, residency, or active trade tests. If a fund fails to meet these conditions, it may lose access to reduced withholding tax rates.

Some treaties impose additional restrictions, limiting benefits to pension funds established under the laws of a contracting state and requiring that most of their beneficiaries are residents or citizens of that state. Challenges also arise if a pension fund doesn’t fit the treaty’s definition of a qualifying entity or if its income doesn’t come from active business operations. Meeting these requirements often demands extensive documentation and strict compliance with legal standards, making the process more complex. While these measures are designed to prevent abuse, they can also make it harder for pension funds to fully leverage treaty benefits.