The world of pension fund auditing is undergoing rapid changes driven by regulatory updates, economic pressures, and emerging technologies. Key developments include:

- Regulatory Shifts: The SECURE 2.0 Act introduced stricter rules, like market-based valuations and updated Annual Funding Notices (AFNs) due by April 30, 2025, in the U.S. Globally, pension funds are aligning with uniform reporting standards.

- Economic Challenges: Rising interest rates and market volatility are increasing liquidity risks. For instance, a 0.1% change in discount rates can shift liabilities by millions.

- Technology in Audits: AI is enabling real-time risk detection, while blockchain is improving transparency. However, these tools require robust oversight to mitigate risks like flawed data or cybersecurity threats.

- Updated Actuarial Models: New mortality assumptions and higher discount rates are reshaping pension liability calculations, impacting funding strategies.

- Tighter Deadlines: Filing deadlines are shorter, demanding faster and more accurate data processing.

Pension fund administrators must navigate these changes by adopting advanced tools, ensuring compliance, and focusing on data security. The integration of technology, alongside human expertise, is becoming critical for success in this evolving landscape.

Pension Fund Auditing Key Statistics and Trends 2025

Regulatory Changes Affecting Pension Audits

Updated Compliance Requirements

In 2025, the SECURE 2.0 Act introduced significant changes to pension fund audits. One key shift was replacing the traditional "Funding Target Attainment Percentage" (FTAP) with a new metric focused on plan liabilities funded. Following this, in April 2025, the Department of Labor (DOL) issued Field Assistance Bulletin (FAB) 2025-02, which updated how auditors verify plan reporting. Under the new guidelines, plans must now compare asset values against year-end liabilities using market interest rates.

For calendar-year plans, the first Annual Funding Notices (AFNs) that complied with SECURE 2.0 were due by April 30, 2025. These notices require more detailed reporting, such as the "average return on assets" for the plan year and demographic breakdowns of active employees, retirees currently receiving benefits, and retirees eligible for future benefits. Plans that issued their 2024 AFNs before the April guidance must revisit those disclosures to ensure compliance.

The SEC has also stepped up its regulatory oversight. On November 17, 2025, the Division of Examinations revealed its 2026 priorities, emphasizing adherence to fiduciary duties, the custody rule, and the 2024 amendments to Regulation S-P concerning data privacy and protection. These priorities aim to help firms prepare for SEC examinations while improving transparency around the agency’s focus areas.

These domestic changes are part of a larger global shift toward more uniform reporting standards.

International Reporting Standards

The regulatory updates in the U.S. align with global efforts to improve audit transparency and standardization. In June 2025, the U.S. Government Accountability Office (GAO) released a revised Financial Audit Manual (FAM), which introduced updated methodologies for auditing financial statements of federal entities. This revision aims to strengthen accountability for taxpayer resources.

While U.S. pension funds primarily follow ERISA and domestic standards rather than IFRS, the global trend toward market-based valuations and enhanced disclosure requirements is evident. These changes are designed to give stakeholders a clearer understanding of pension fund health and long-term sustainability.

Technology and AI in Pension Fund Auditing

Automated Data Processing

Technology is reshaping how audits are conducted, offering greater precision and aligning with evolving regulatory demands. One notable shift is the move from manual sampling to analyzing entire datasets. This comprehensive approach allows auditors to reconcile payroll data more effectively. Helen Pierpoint and Amelia Pickard, Technical Managers at ICAEW, highlight this trend:

it is increasingly common for sponsor auditors to request the member data file in full

By working with complete datasets, auditors can ensure a higher level of accuracy when comparing data against payroll records.

Electronic bank confirmation portals have also become standard tools, streamlining the process of verifying scheme bank balances. These platforms significantly cut down the time required compared to traditional written requests, though some banks still occasionally rely on written confirmations. Given the variability in bank response times, early planning remains critical, even when using electronic methods.

Auditors are now directly testing cash flow data managed by administrators to confirm that transactions are properly classified and recorded within the correct timeframes. Assurance mapping has emerged as a key approach, linking data from various sources – such as internal and external audits – to specific risks that could impact pension scheme objectives. Trustees should also work with auditors to address data privacy concerns, ensuring sensitive information like member addresses is redacted to comply with GDPR regulations.

Building on these advancements, AI is pushing the boundaries of risk detection and audit efficiency.

AI for Risk Assessment

AI is revolutionizing audits by shifting them from periodic reviews to continuous monitoring systems capable of identifying risks as they arise. Unlike traditional methods that rely on manual sampling, AI can analyze every transaction to detect anomalies, such as unusual patterns, round-number entries, or transactions occurring on weekends or holidays, which could indicate fraud. This marks a transition from reactive analysis to proactive risk management.

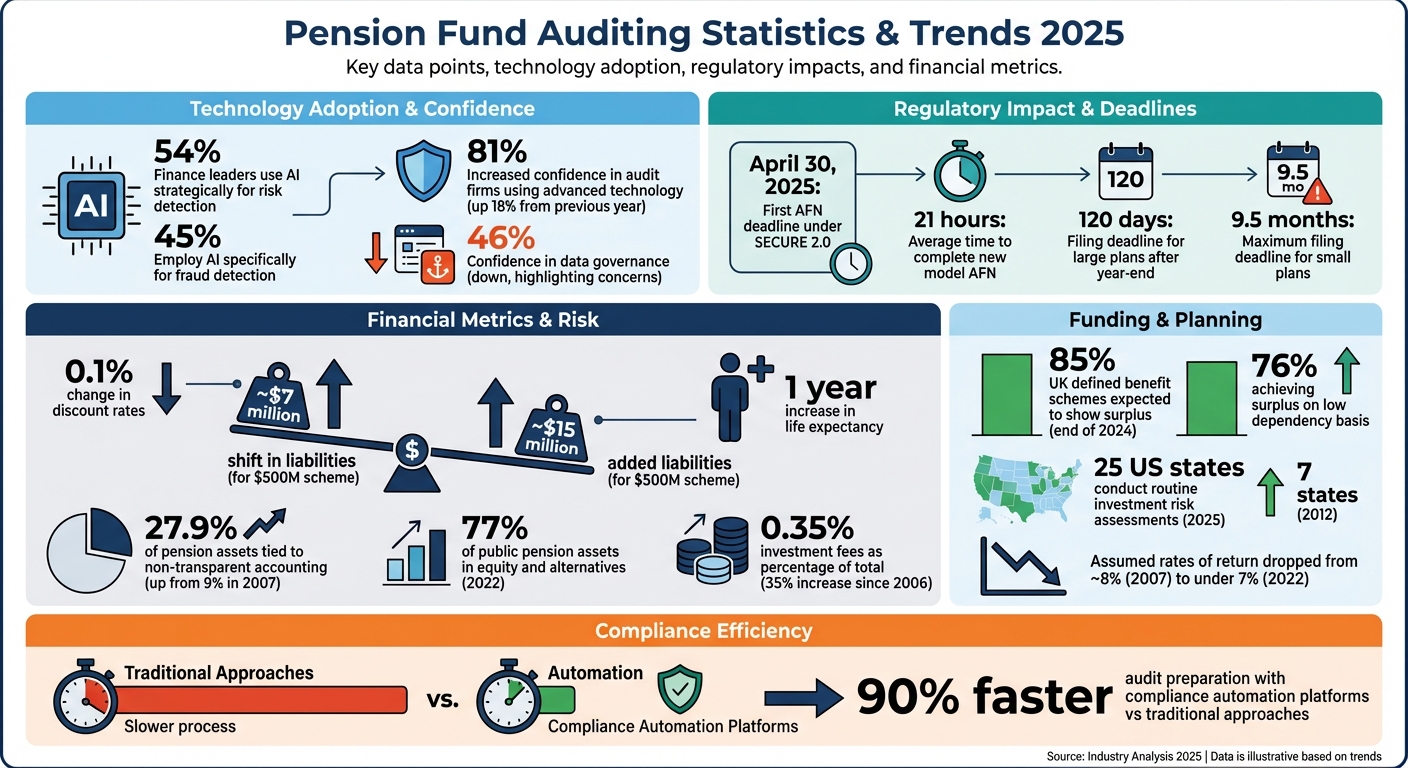

Statistics back up this transformation: 54% of finance leaders now use AI strategically for risk detection and management, while 45% employ it specifically for fraud detection. Machine learning models are even being used to predict potential risks, enabling administrators to address issues before they escalate. Brian Miller, Assurance Managing Principal at BDO, underscores this shift:

audit technology has reached an inflection point. Finance leaders no longer ask if their auditor uses advanced technology – they expect it

However, while AI offers impressive capabilities, it doesn’t replace human expertise. AI excels at processing data but lacks the ethical judgment and professional skepticism that human auditors bring to the table. Moreover, the quality of AI’s insights depends heavily on the accuracy of the data it processes. Poor data can lead to flawed conclusions, making regular reviews by experienced auditors essential to uphold the integrity of the audit process.

Alongside AI, blockchain is emerging as a powerful tool for enhancing transparency in audits.

Blockchain for Audit Transparency

Blockchain technology is being recognized for its potential to transform financial systems by improving transparency and reducing risks. The tokenization of securities and assets on shared ledgers is expected to enhance both security and accessibility in financial markets.

For example, in June 2025, Texas Governor Greg Abbott signed Senate Bill 21, creating the Texas Strategic Bitcoin Reserve. This state-managed fund, overseen by the Texas Comptroller of Public Accounts and advised by crypto experts, holds Bitcoin as a long-term asset and inflation hedge. Similarly, in August 2025, the Wyoming Stable Token Commission is set to launch the Wyoming Stable Token (WYST). Backed by US Treasury securities, this state-issued stablecoin will allocate part of its income to support Wyoming’s public schools.

The adoption of advanced technologies in audits is building trust among finance leaders, with 81% reporting increased confidence in audit firms using these tools – an 18% rise from the previous year. However, concerns over data governance remain, with confidence levels dropping to 46% in 2025. This highlights the need for robust oversight and governance frameworks as tools like blockchain become more widely implemented.

Changes in Accounting Assumptions and Mortality Models

Updated Mortality Assumptions

Shifts in technology and regulations are reshaping audit practices, and changes in actuarial assumptions are having a similar impact on pension fund liabilities. In 2025, updates to actuarial models brought new methods for calculating pension liabilities. The Continuous Mortality Investigation (CMI) 2024 model, set to launch in Q2 2025, introduces a "half-life" parameter to replace the previous "w" parameter, addressing the lingering effects of pandemic-related mortality trends.

Recent figures highlight a significant divide in mortality rates: older age groups are experiencing record-low mortality, while younger populations are seeing elevated rates. Since members of defined benefit pension schemes are typically older, the adoption of the CMI 2024 model is likely to increase liabilities for most pension plans. For example, in a scheme with $500 million in liabilities, just a one-year increase in life expectancy could add about $15 million to the total liabilities.

On the regulatory side, as of January 1, 2025, the Actuarial Standards Board has updated ASOP No. 27, requiring assumptions to be both "reasonable" and free of "significant bias". Plan administrators will need to work closely with actuaries to assess the implications of the new half-life parameter and ensure that financial disclosures are clear and concise.

Discount Rate Adjustments

Alongside changes to mortality assumptions, adjustments to discount rates are altering the financial calculations behind pension schemes. At the start of 2025, rising bond yields pushed the median discount rate for pension accounting from 4.8% to 5.8% annually. This increase was driven by a 0.15% to 0.25% rise in yields on UK government and corporate bonds.

Higher discount rates reduce the present value of future obligations. For a pension scheme with $500 million in liabilities, a 0.1% change in the discount rate translates to a roughly $7 million shift in liability calculations. Meanwhile, credit spreads widened by about 0.10%, reflecting heightened economic uncertainty.

In line with ASOP No. 27, the combined effects of discount rates, inflation, and mortality assumptions must remain free from material bias. These updates emphasize the need for precision and transparency in pension reporting. Administrators are encouraged to keep a close eye on bond yield trends and conduct secondary reviews following major economic developments.

New Reporting Requirements and Filing Deadlines

Improved Annual Report Standards

Under the SECURE 2.0 amendments to ERISA section 101(f), pension fund administrators now face stricter transparency rules. One of the most notable changes is the introduction of a new metric that measures the percentage of plan liabilities funded. This metric is calculated by dividing the fair market value of assets by year-end liabilities.

Annual Funding Notices (AFNs) must now provide participant counts in three categories: those currently receiving benefits, those entitled to future benefits, and active participants. Additionally, they are required to report the average return on assets using one of two Department of Labor (DOL)-approved methods. These updates are designed to make reports easier for participants to understand, with clear explanations about the consequences of underfunding and the limits of Pension Benefit Guaranty Corporation (PBGC) guarantees.

The DOL estimates that completing the new model AFN takes administrators an average of 21 hours. To comply, administrators must use the updated model notices outlined in FAB 2025-02, as older templates no longer meet the revised ERISA standards. These changes, paired with tighter filing timelines, increase the pressure on administrators to be both accurate and efficient.

Shorter Filing Deadlines

The new deadlines, building on earlier regulatory updates and advancements in technology-driven reporting, present additional challenges for administrators. By requiring year-end data collection, the timeline for compliance has been significantly shortened.

For large plans, AFNs must be filed within 120 days after the end of the plan year. While reasonable estimates for participant counts and year-end liabilities are allowed, administrators must clearly disclose when estimates are used. Small plans, on the other hand, have stricter rules. They must file by the earlier of their Form 5500 filing date or the latest possible deadline – generally 9.5 months after year-end – and are not permitted to use estimates.

To meet these tighter deadlines, administrators are encouraged to collaborate closely with actuaries to finalize calculations promptly. Leveraging RegTech tools to automate disclosure preparation can also help reduce the risk of manual errors and streamline compliance efforts.

sbb-itb-9792f40

Funding, Risk Management, and Compliance

Pension fund administrators continue to adapt their strategies to keep pace with regulatory and technological changes, focusing on funding, risk management, and compliance.

Improved Funding Strategies

Pension funds are moving from deficit recovery plans to what’s being called "endgame" planning. By the end of 2024, 85% of UK defined benefit schemes were expected to show a surplus based on Technical Provisions, with 76% achieving surplus on a "low dependency" basis. This shift means many schemes no longer rely on additional employer contributions to meet their obligations.

A new focus on alternative asset allocations is shaping funding strategies. For example, in 2022, the California Public Employees’ Retirement System (CalPERS) allocated 5% of its portfolio to private debt, reflecting a broader trend among U.S. public pensions seeking higher returns through private credit. At the same time, public pension plans have lowered their assumed rates of return, dropping from around 8% in 2007 to just under 7% in 2022, aligning with more realistic economic expectations.

"With this continued strong funding position, we expect most schemes to be shifting their focus from deficit recovery to endgame planning." – The Pensions Regulator

Schemes are also exploring contingent asset support, using guarantees to take calculated risks while maintaining full funding. However, The Pensions Regulator emphasizes that "low dependency is not no dependency", noting that covenant support will still be necessary until a scheme is transferred or wound up. Trustees are now tasked with monitoring a "reliability period" of three to six years, during which cash flows need to remain predictable.

These funding adjustments are paving the way for a deeper examination of financial and operational risks.

Measuring Financial and Operational Risks

By 2022, equity and alternative investments accounted for 77% of total public pension plan assets. Investment fees for public pension funds rose to 0.35% of total investments – a 35% increase since 2006. Notably, the New York State and Local Retirement System reported that performance-based "carried interest" fees for private equity were more than triple its standard management fees in 2022.

To manage these risks, pension funds are turning to forward-looking stress tests and scenario analyses. As of 2025, 25 U.S. states conduct routine assessments of investment risks, a significant increase from just seven states in 2012. Maryland was the first state to publish annual scenario analyses addressing climate-related financial risks, following legislation passed in 2018. Additionally, the South Dakota Retirement System used risk analysis during the COVID-19 pandemic to evaluate its ability to handle market volatility.

Many organizations are implementing the "Three Lines of Defense" model, which separates operational management (first line), compliance oversight (second line), and independent audits (third line). Trustees are using assurance mapping to connect audit findings to specific risks, ensuring no gaps in their risk management frameworks. For schemes utilizing leveraged liability-driven investment (LDI) strategies, regular stress testing is essential to confirm that interest rate buffers can be replenished within five days.

Maintaining Compliance Standards

Compliance efforts are evolving alongside risk management, now encompassing financial reporting, AI governance, cybersecurity, and vendor oversight. Administrators must address AI-related concerns like bias, conflict of interest, and transparency. This is particularly important as 27.9% of pension fund assets are now tied to non-transparent accounting methods, up from 9% in 2007 – a trend regulators refer to as "valuation risk".

Cybersecurity has become a top priority, with administrators adopting Zero Trust Architecture (ZTA) and ensuring systems comply with SEC and FINRA standards. Regulatory Technology (RegTech) is being used to automate processes like Know Your Customer (KYC) and Anti-Money Laundering (AML), while also generating real-time audit trails.

When assurance reports from service providers don’t cover the full financial period, trustees are encouraged to request bridging letters to confirm that the control environment remains unchanged. Even for well-funded schemes, trustees should maintain proportionate monitoring of employer covenants and establish clear policies for releasing surplus funds, aligning with specific rules and anticipated legislation.

What This Means for Pension Fund Administrators

By 2025, pension fund administrators face the challenge of modernizing their operations while navigating stricter regulatory oversight. The Public Company Accounting Oversight Board (PCAOB) is now emphasizing the importance of technology and Generative AI in audits. With pension funds increasingly exposed to valuation risks and alternative investments, the use of advanced tracking and auditing tools is no longer optional – it’s essential.

Adopting New Technologies

The integration of AI and blockchain into pension fund operations must be done thoughtfully. Governance frameworks are critical to managing risks like algorithmic bias or AI hallucinations, and human oversight remains indispensable. For funds involving digital assets, administrators should prioritize on-chain fraud detection and anti-money laundering (AML) reviews, maintain an up-to-date inventory of vendors, and conduct thorough due diligence.

"New technologies bring about new risks, and corporate governance and supervision frameworks need to keep pace." – Sidley Austin LLP

Technology is also key to tackling valuation complexities. For example, improvements in bond-matching techniques and yield curve modeling demand greater judgment when evaluating pricing data. Additionally, regularly updating mortality models with the latest improvement scales, such as MIM-2021, ensures actuarial assumptions are aligned with the most current data.

Protecting Data and Cybersecurity

The rise in cyber threats calls for robust security measures. Implementing multi-factor authentication (MFA), least-privilege access controls, and strong identity verification protocols – even for remote access – is essential. Network segmentation, hardened Active Directory settings, and encrypted off-network backups further protect digital assets. To combat social engineering attacks, administrators should provide targeted training for staff.

When sharing member data, it’s crucial to redact any GDPR-sensitive information that isn’t necessary. Vendors should also be required to provide up-to-date assurance reports and bridging letters to verify their compliance with security standards. These steps help ensure that sensitive information remains secure in an increasingly digital landscape.

Conclusion

The landscape of pension fund auditing in 2025 demands a move toward modern compliance methods and operational precision. Audits have become essential tools for managing risk. With AI now capable of analyzing complete datasets instead of just samples, blockchain providing greater transparency, and regulators like the PCAOB increasing their focus on technology and quality control, the old ways simply don’t cut it anymore.

Here’s a telling statistic: compliance automation platforms can prepare organizations for audits 90% faster than traditional approaches. At the same time, high-profile incidents emphasize the importance of addressing digital risks. Together, these points highlight the growing necessity of blending advanced technology with human expertise.

To succeed, pension fund administrators need to combine their expertise with cutting-edge tools. This reflects the broader trend of integrating AI and blockchain into audits. As Scytale puts it:

A balanced approach that combines both human expertise with the help of AI capabilities is essential to avoid vulnerabilities.

This means adopting practices like the Three Lines of Defense model, prioritizing strong cybersecurity measures, and treating data governance as a must-have rather than an afterthought.

Administrators who prepare early, verify third-party controls through AAF 01/20 reports and bridging letters, and collaborate with auditors as strategic allies will be better equipped to handle tightened deadlines and stricter reporting standards. The pension funds that thrive will be the ones that see regulatory and technological shifts as opportunities to improve their operations and serve their members more effectively.

Of course, this transition won’t be without its hurdles – especially with the ongoing talent shortage in the audit profession. But with proactive planning, open communication, and a commitment to continuous improvement, pension fund administrators can turn these challenges into opportunities for long-term success.

For those aiming to stay ahead, working with a trusted partner like Charter Group Fund Administration can help seamlessly integrate forward-thinking compliance and risk management strategies into everyday operations.

FAQs

What changes does the SECURE 2.0 Act bring to pension fund audits in 2025?

The SECURE 2.0 Act brings new audit requirements for employee benefit plans, set to take effect in 2025. These updates are designed to improve transparency and ensure alignment with changing regulatory expectations.

For plan sponsors, this means reworking their audit processes to meet the updated standards. Key adjustments will involve adhering to revised reporting requirements and maintaining broader documentation to comply with the Act’s provisions.

How is AI transforming pension fund audits in 2025?

AI is transforming the way pension fund audits are conducted, offering a new level of efficiency and precision. With the power of machine learning and generative AI, auditors can now tackle enormous, complex data sets at speeds that were unimaginable with traditional methods. Tasks like processing member records, evaluating investments, and analyzing cash-flow data are handled automatically, allowing AI to quickly detect anomalies and potential risks. Plus, predictive models provide trustees with a sharper understanding of future funding requirements, helping them plan for long-term solvency.

Another game-changer is real-time auditing, made possible by AI’s ability to integrate seamlessly with fund administration systems. This technology enables continuous transaction monitoring, instant reporting of exceptions, and significantly shorter review cycles. By automating repetitive tasks like data reconciliation, auditors are freed up to concentrate on deeper analysis and strategic risk management.

In short, AI not only boosts accuracy and shortens audit timelines but also ensures pension funds stay aligned with changing regulatory demands. This shifts audits from being a mere compliance task to becoming a proactive tool for better governance.

Why do updated mortality assumptions matter for pension fund liabilities?

Updated mortality assumptions play a key role in determining the present value of future benefit payments. These assumptions directly influence a pension plan’s funding goals and how its liabilities are valued. For example, shifts in life expectancy estimates can dramatically change the financial picture of a pension fund, often necessitating adjustments to maintain its long-term stability.