Digital assets like Bitcoin, Ethereum, stablecoins, and NFTs are reshaping how we assess value. Unlike traditional markets, crypto operates 24/7, with fragmented exchanges and unique risks like extreme volatility, manipulation, and custody issues. Accurate valuation is critical for regulatory compliance, investor trust, and audit readiness. Here’s what you need to know:

- Valuation Methods: Key approaches include market-based (exchange prices), income-based (cash flows like staking rewards), and network usage-based (metrics like transaction volume).

- Challenges: Issues include fragmented price discovery, data quality concerns, liquidity constraints, and regulatory scrutiny.

- Regulations: U.S. GAAP (ASC 820) and SEC rules require clear valuation policies, detailed documentation, and adherence to fair value standards.

- Emerging Trends: AI tools, institutional adoption, and new accounting updates (e.g., FASB Subtopic 350-60) are shaping the future of crypto valuation.

Understanding these complexities ensures compliance and builds trust in an unpredictable market.

Understanding Tokenomics and the Value of Digital Assets

Digital Asset Valuation Methodologies

Digital Asset Valuation Methods Comparison: Market-Based vs Income-Based vs Network-Based

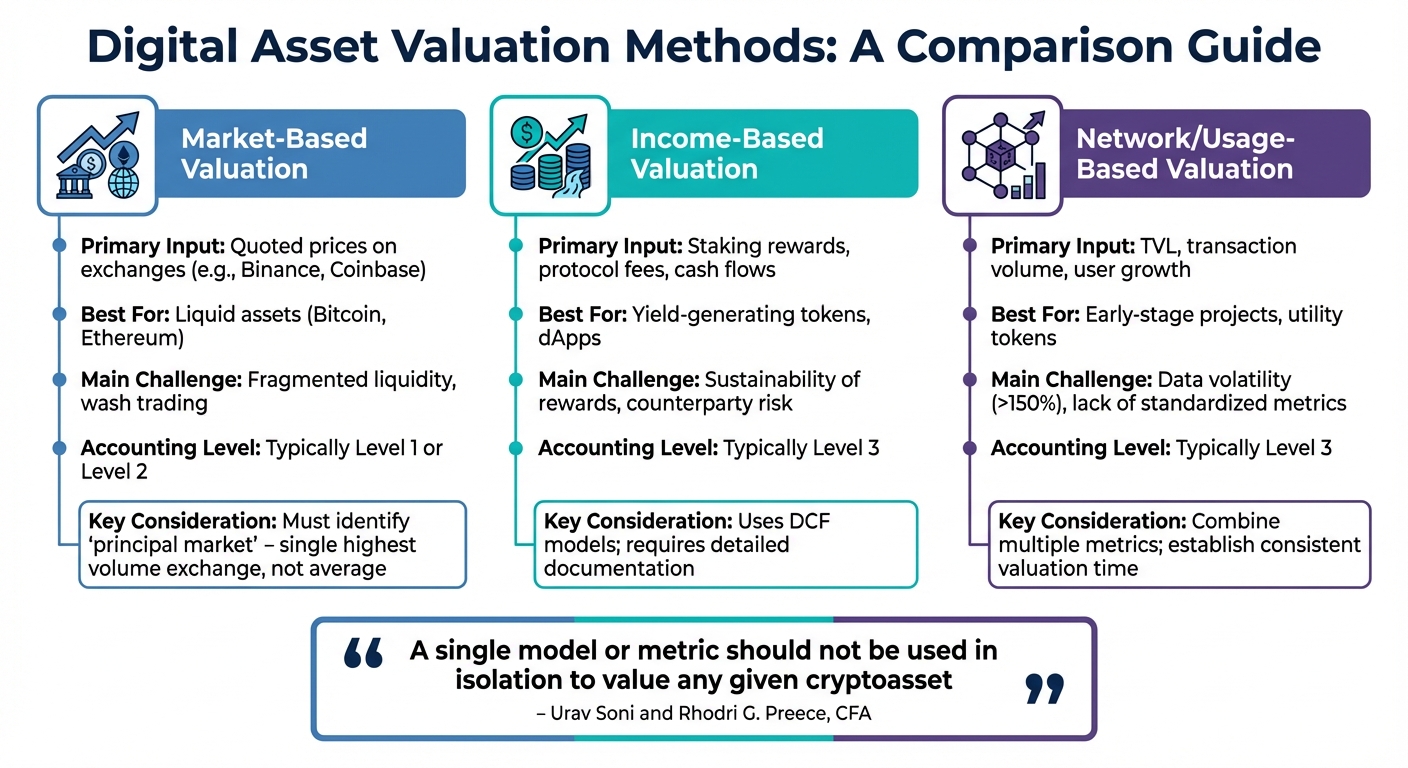

Valuing digital assets isn’t a one-size-fits-all process. Different assets, liquidity levels, and data availability call for distinct approaches. The three main methods – market-based, income-based, and network usage-based – each address unique aspects of crypto assets. Knowing when and how to use these methods is key for accurate NAV calculations and staying compliant with regulations.

Market-Based Valuation

Market-based valuation uses observable prices from active exchanges to determine fair value. Following ASC 820 and IFRS 13 guidelines, this method prioritizes "Level 1" inputs, meaning unadjusted quoted prices for identical assets in active markets. A critical step here is identifying the "principal market" – the exchange with the highest volume and activity that your fund can access.

Fragmented trading infrastructure often complicates this method. For instance, in October 2025, Ethereum’s price showed significant variation across exchanges: Upbit listed it at $4,148.91, while Binance and Coinbase ranged between $3,977.42 and $3,994.30 – a difference of nearly $170. Instead of averaging these prices, it’s essential to determine which accessible market has the highest volume and use that specific price for fair value.

"The identification of the principal or most advantageous market is a single market, not an average across markets." – PwC

Wash trading adds another layer of complexity. In October 2024, the SEC charged ZM Quant Investment Ltd. with fraud for manipulating market-based inputs through artificial trading volume. This underscores the importance of verifying data quality, particularly during Initial Coin Offerings (ICOs), where manipulation risks are higher.

For locked or vesting tokens, a Discount for Lack of Marketability (DLOM) must be applied to the observable market price of freely tradable tokens. Tools like the Ghaidarov Average Strike Protective Put model can help calculate this discount. However, with volatility exceeding 150%, traditional Black-Scholes models may produce unstable results.

While market-based valuation focuses on current exchange prices, income-based valuation shifts the lens to future cash flow potential.

Income-Based Valuation

Income-based valuation uses Discounted Cash Flow (DCF) models to assess digital assets that generate income, such as staking rewards, protocol fees, or governance revenues. This method is particularly suited for smart contract platforms and decentralized applications (dApps) that produce measurable cash flows, making it easier to estimate NAV for assets with clear income streams.

However, challenges arise with sustainability and counterparty risk. Unlike traditional financial instruments like bonds or dividend-paying stocks, many crypto protocols lack a proven track record. Staking rewards, for instance, can fluctuate based on network activity, protocol upgrades, or governance decisions. Revenue projections often hinge on assumptions about user adoption, competition, and regulatory changes, all of which introduce significant uncertainty.

Because this approach relies heavily on unobservable inputs, it typically falls under "Level 3" in the fair value hierarchy. This requires detailed documentation and professional judgment. For Simple Agreements for Future Tokens (SAFTs), valuations should be adjusted based on performance relative to expectations and the likelihood of token issuance – the "trigger event" – actually happening.

"Calibration is the process of using observed transactions in the portfolio company’s own instruments… to ensure that the valuation techniques… begin with assumptions that are consistent with the original observed transaction." – Houlihan Capital Whitepaper

Network and Usage-Based Valuation

For early-stage projects without traditional financial histories, network and usage metrics offer another way to measure value. This approach evaluates network-specific metrics like transaction volume, total value locked (TVL), active addresses, and protocol efficiency. It’s particularly useful for utility tokens, where standard financial metrics don’t apply.

The main hurdles here are data volatility and the absence of standardized metrics. With token volatility often exceeding 150%, it’s tough to select a stable, point-in-time metric for network activity. Additionally, there’s no universally accepted method for measuring network health or protocol efficiency across different blockchain ecosystems.

"A single model or metric should not be used in isolation to value any given cryptoasset." – Urav Soni and Rhodri G. Preece, CFA

To address these challenges, analysts should combine multiple metrics – such as transaction fees, developer activity, and governance participation – rather than relying on just one. Establishing a consistent valuation time (like midnight EST or 5 p.m. EST) can help minimize the impact of 24/7 trading and extreme intra-day price swings. Clear documentation of your methods is essential to meet audit and regulatory requirements.

| Feature | Market-Based | Income-Based | Network/Usage-Based |

|---|---|---|---|

| Primary Input | Quoted prices on exchanges (e.g., Binance, Coinbase) | Staking rewards, protocol fees, cash flows | TVL, transaction volume, user growth |

| Best For | Liquid assets (e.g., Bitcoin, Ethereum) | Yield-generating tokens, dApps | Early-stage projects, utility tokens |

| Main Challenge | Fragmented liquidity, wash trading | Sustainability of rewards, counterparty risk | Data volatility, lack of standardized metrics |

| Accounting Level | Typically Level 1 or Level 2 | Typically Level 3 | Typically Level 3 |

Charter Group Fund Administration specializes in NAV calculation services for crypto funds, helping navigate these complex valuation methods while ensuring compliance with accounting standards and regulatory requirements.

Technical and Data Challenges

Even with solid valuation methods in place, technical and data-related issues continue to pose significant obstacles to accurately pricing digital assets. The decentralized and round-the-clock nature of crypto markets – combined with diverse data sources and liquidity challenges – makes it tough to determine reliable fair values for NAV (Net Asset Value) calculations.

Fragmented Price Discovery

Digital assets are traded across a wide array of centralized and decentralized exchanges, each with its own order book, liquidity levels, and user base. This fragmented setup leads to price differences, making it difficult to pinpoint a single "principal market" for determining fair value.

Under ASC 820 and IFRS 13, fair value must be based on the "principal market", defined as the exchange with the highest volume and activity accessible to the fund, rather than an average of multiple platforms.

"The identification of the principal or most advantageous market is a single market, not an average across markets." – PwC

Price manipulation risks, such as wash trading, add another layer of complexity to accurate price discovery. Furthermore, the continuous trading environment requires funds to set a fixed valuation time (e.g., midnight EST) to help manage the impact of intraday price volatility.

Data Quality and Pricing Sources

The reliance on third-party data aggregators, like CoinMarketCap, introduces additional risks. These platforms often use inconsistent methods to calculate composite prices and may include data from exchanges with low liquidity or questionable trading practices. A 2025 survey revealed that 76% of fund groups conduct annual due diligence on their pricing vendors to ensure the reliability of the data they provide.

During periods of extreme market volatility, data outages and API failures are common, requiring analysts to swiftly switch to backup sources while ensuring consistency with their valuation policies.

"Valuation remains clouded with uncertainty due to the absence of standardized valuation frameworks and methods, a market infrastructure that is often fragmented, and limited technological transparency." – Antonella Puca, CFA, CIPM, CPA/ABV and Mark L. Zyla, CFA, CPA

Foreign exchange (FX) conversion risks also complicate pricing, as tokens may trade in various currencies like USD, EUR, or KRW, or even against other cryptocurrencies such as BTC or ETH. Nearly 50% of surveyed fund groups have reported facing SEC inquiries regarding their compliance with Rule 2a-5, underscoring the need for precise fair value determinations.

Liquidity and Market Impact

Liquidity issues are especially pronounced for small-cap tokens and early-stage crypto projects. Thin order books can lead to significant slippage when attempting to liquidate large holdings. According to ASC 820 and IFRS 13, blockage discounts cannot be applied to Level 1 assets, meaning fair value must be calculated as Price × Quantity.

Market impact, or the theoretical slippage from selling a large position, cannot be used to reduce fair value. However, a Discount for Lack of Marketability (DLOM) may be applied if the tokens have legal or contractual restrictions, such as vesting schedules, that would transfer to the buyer.

"Under the fair value standard of ASC 820 and IFRS 13, blockage discounts are not permitted. There is, however, the possibility of applying a discount for lack of marketability when the tokens themselves carry restriction features that would transfer from the seller to the buyer." – Antonella Puca, CFA and Mark L. Zyla, CFA

For illiquid assets with insufficient trading frequency or volume to provide consistent pricing, reclassification from Level 1 (quoted prices) to Level 2 or Level 3 (valuation models) may be necessary. This shift demands additional documentation and careful professional judgment.

These technical hurdles directly influence the operational strategies discussed in the next section.

Charter Group Fund Administration supports crypto funds by offering specialized NAV calculation services. Their expertise helps address fragmented pricing, ensures rigorous vendor evaluations, and conducts thorough liquidity assessments – all while adhering to current accounting standards.

Regulatory and Compliance Requirements

Navigating the regulatory framework for digital asset valuation is no small task. Fund managers must juggle multiple guidelines from U.S. authorities, balancing tax laws, accounting standards, and securities regulations. Here’s a closer look at the key U.S. accounting rules, tax considerations, and valuation policies that shape compliance for digital assets.

Accounting Standards for Digital Assets

The complexities of valuing digital assets have led to new accounting standards under U.S. GAAP. The Financial Accounting Standards Board (FASB) introduced Accounting Standards Update (ASU) 2023-08, which created Subtopic 350-60. This update focuses on the accounting and disclosure of crypto assets within U.S. GAAP.

Under the fair value hierarchy outlined in ASC 820, digital assets are classified based on the availability of market data:

- Level 1: When unadjusted quoted prices for identical assets are available in active markets at the measurement date.

- Level 2 or Level 3: When observable data is less readily accessible, requiring adjustments or alternative valuation methods.

Tax Implications and Reporting

The IRS treats digital assets as property for federal income tax purposes, applying the same tax principles as those used for property transactions. Starting in 2024, taxpayers must answer a digital asset-related question on forms like 1040, 1041, 1065, 1120, and 1120-S, even if no transactions occurred.

One of the biggest challenges involves tracking the cost basis. For unhosted wallets, taxpayers need to record purchase dates, prices, or unique identifiers. Assets acquired through airdrops or staking are considered ordinary income, valued at fair market value (FMV) upon receipt. For large charitable donations, appraisals are required. Section 1256 contracts tied to digital assets are treated as sold at FMV on the last business day of the taxable year, with gains and losses split 40% short-term and 60% long-term. Additionally, transaction costs like gas fees and commissions must be accounted for, as they directly impact cost basis calculations.

New reporting rules for brokers take effect soon:

- January 1, 2025: Gross proceeds from digital asset sales must be reported.

- January 1, 2026: Customer basis reporting begins.

Valuation Policies and Regulatory Oversight

Under SEC Rule 2a-5, fund boards can assign a valuation designee to handle daily fair value assessments, but this role comes with strict oversight requirements. SEC Rule 31a-4 further mandates that funds or their advisers maintain detailed records to support fair value measurements.

"Main Street investors increasingly access our capital markets through funds and rely on them to value their investments properly. Today’s rule is designed to improve funds’ valuation practices, including by providing for effective board oversight, for the benefit and protection of fund investors."

- Jay Clayton, Chairman, SEC

For the SEC, a market quotation is considered "readily available" only if it is an unadjusted quoted price from an active market for identical investments at the measurement date. Fund managers acting as valuation designees must clearly define responsibilities and ensure proper segregation of duties to stay compliant.

Charter Group Fund Administration offers specialized compliance services for crypto funds, including AML, CRS, and FATCA reporting. Their expertise in offshore jurisdictions, such as the Cayman Islands, helps fund managers navigate the intricate web of U.S. tax obligations, SEC oversight, and international reporting requirements. They also ensure that all valuation determinations are thoroughly documented.

sbb-itb-9792f40

Operational Challenges and Governance

Beyond the technical and regulatory hurdles, operational challenges in managing digital assets require a fresh approach. Fund managers are tasked with rethinking workflows, especially when it comes to valuing these assets. The nonstop nature of cryptocurrency markets clashes with the traditional processes for calculating net asset value (NAV). Unlike equities, which stop trading at 4:00 p.m. ET, digital assets trade around the clock on global exchanges. This forces funds to define specific valuation points and cut-off times. Without clear guidelines in their offering documents, administrators face tough decisions about which price to use when calculating daily NAV. Let’s dive into how continuous trading impacts NAV timing and custody processes.

NAV Calculation and Timing

The 24/7 trading landscape creates challenges that extend far beyond simply picking a valuation time. Cryptocurrencies often trade on multiple platforms simultaneously, with prices varying across exchanges. To address this, funds must establish clear policies on which exchange serves as the primary pricing source. For assets in continuous global markets, some funds implement threshold-based triggers – like a specific percentage move in a domestic index – to decide when to apply fair value adjustments instead of relying on closing prices.

Accepting cryptocurrency subscriptions adds another layer of complexity. Administrators must validate the source of funds, monitor specific digital wallets, and manage the conversion of crypto subscriptions into the fund’s base currency, typically USD. Given the high volatility of digital assets, the timing of these conversions can significantly affect NAV, especially during rapid price swings.

Custody and Reconciliation

The shift from traditional asset custody to digital asset safekeeping has introduced a new set of challenges. Regulatory jurisdictions, such as the Cayman Islands, require funds to segregate assets and appoint independent custodians or verifiers of title. The industry has largely moved away from self-custody – where funds hold private keys themselves – toward using third-party digital asset custodians. These custodians offer enhanced security measures like cold storage and multi-signature protocols, aligning with regulatory expectations.

However, this transition brings its own reconciliation difficulties. Administrators must constantly verify wallet balances across multiple exchanges and custodians, a task complicated by the fragmented nature of digital asset infrastructure. To streamline operations, fund managers are encouraged to involve administrators early in the fund-launch process. This ensures that supported exchanges and self-hosted wallet compliance align with the fund’s policies. Additionally, diversifying custody and exchange partners can help mitigate counterparty risk.

Role of Specialized Fund Administrators

Navigating these operational challenges requires a strong governance framework, which specialized fund administrators are equipped to provide. Under SEC Rule 2a-5, fund boards often appoint the investment adviser as the "Valuation Designee", while administrators play a critical role in the oversight process. Although administrators don’t make independent fair value judgments, they collaborate with investment advisers and valuation committees to assign values to complex assets. This separation of valuation duties from portfolio management helps prevent conflicts of interest.

"Fund administrators are typically responsible for obtaining such values – both readily available market prices and fair valuations – from the sources authorized by the fund’s policies and procedures." – Independent Directors Council (IDC)

Charter Group Fund Administration exemplifies how specialized administrators can address the unique demands of crypto funds. Their governance framework supports accurate NAV calculations, from reconciling balances across multiple custodians to managing crypto-based subscriptions. By participating in valuation committees and ensuring adherence to valuation policies, these administrators help funds maintain audit-ready processes that comply with both SEC and CIMA standards.

Emerging Trends in Digital Asset Valuation

The landscape of digital asset valuation is undergoing a transformation as fund managers tackle technical challenges and meet regulatory expectations. Institutional involvement and advancements in technology are reshaping how valuation frameworks are designed to address the demands of a rapidly evolving market. These developments signal a shift in the industry, building on the challenges already faced.

Institutional Adoption of Digital Assets

Institutional investors are driving a shift in digital asset valuation, moving from basic price tracking to more thorough fair value assessments. Recent surveys reveal that 6% of investment fund groups now include digital assets in their portfolios, with most actively monitoring these holdings for valuation purposes. This trend has led to greater alignment with ASC 820 and IFRS 13 standards, steering the industry away from speculative pricing and toward methodologies based on market participant assumptions.

To address the complexities of valuing illiquid Level 3 assets – such as SAFTs (Simple Agreements for Future Tokens) and private equity positions in the crypto space – institutions are increasingly relying on third-party valuation specialists. This approach minimizes conflicts of interest and ensures a more impartial determination of fair value.

For tokens that are locked or subject to vesting, institutions are favoring the Ghaidarov model over the traditional Black-Scholes framework, particularly in cases of extreme volatility exceeding 150%. Governance practices have also seen significant improvements, with 79% of fund Boards now reviewing price challenge information during every meeting.

AI and Automation in Valuation

Technological advancements are playing a pivotal role in simplifying the complexities of digital asset valuation. AI and automation are becoming indispensable tools, with surveys indicating that over 90% of investment managers are either using or planning to use AI in their processes. Of these, 54% have already integrated AI into various aspects of their strategies. These advanced systems can analyze more than a million data points daily, enabling real-time pattern recognition and sentiment analysis across both structured and unstructured data sources.

"While its full potential remains to be seen, AI can already provide significant efficiencies in the valuation process. This includes generating documentation, obtaining and summarizing research, and even generating valuations for private equity or debt positions." – Deloitte

Natural Language Processing (NLP) tools are now capable of performing contextual sentiment analysis, picking up subtle cues in earnings call transcripts to provide early warnings about asset performance. For digital assets with limited historical data, AI can generate synthetic datasets that simulate market conditions, allowing for stress-testing of new financial instruments during hypothetical crises.

Despite these advancements, human oversight remains essential. AI systems are not immune to errors, sometimes producing inaccurate outputs or "hallucinations." Experts must carefully review AI-generated results to ensure they align with specific market conditions. Additionally, when using AI-powered valuation platforms, it’s wise to verify their credentials through resources like FINRA’s BrokerCheck to avoid fraudulent schemes claiming "proprietary AI" capabilities.

Stablecoins and Tokenized Real Assets

While AI enhances data analysis, stablecoins and tokenized real assets introduce their own valuation challenges. Stablecoins, which are typically pegged to a fixed value – like 1 USDT equaling $1.00 – require valuation frameworks that can address deviations from parity during market disruptions. Such disruptions can significantly impact the proceeds from digital token sales.

Tokenized real assets, on the other hand, demand adaptations of traditional financial principles to account for risks like credit and liquidity. In March 2023, the FASB proposed updates (Subtopic 350-60) requiring certain crypto assets to be measured at fair value for each reporting period, with changes reflected in net income. These updates also mandate disclosure of key details, including the name, cost basis, fair value, and number of units for significant crypto holdings, as well as the specific valuation methods used.

"Valuations in the cryptoasset sector can be especially tricky because they frequently require… working knowledge of a nascent industry and its new technologies, along with the ability to adapt traditional methods." – Houlihan Capital

Tokenized assets often come with lock-up or vesting provisions, which necessitate advanced models to calculate Discounts for Lack of Marketability (DLOM). For illiquid Level 3 assets, calibration techniques are becoming more common, using observed transaction prices to ensure valuation models align with the original investment assumptions. Analysts must also identify the principal market for these assets, as outlined in ASC 820 and IFRS 13. Highlighting the growing regulatory focus on this sector, the SEC’s Division of Examinations issued a Risk Alert on February 26, 2021, emphasizing the valuation of Digital Asset Securities as a priority for future reviews. This underscores the increasing scrutiny these emerging asset classes face.

Conclusion

Valuing digital assets requires a disciplined approach, strict adherence to regulations, and the expertise to navigate a complex and volatile market. With the global cryptocurrency market capitalization surpassing $4.0 trillion in mid-August 2025, the stakes for accuracy have never been higher. Fund managers face unique challenges, including fragmented pricing data, extreme market swings, and ever-changing accounting standards, all while striving to maintain investor trust and audit transparency.

The cornerstone of reliable valuation lies in sticking to traditional, well-established financial frameworks like discounted cash flow analysis, guideline public company comparisons, and precedent transactions. Ankura Consulting Group underscores this point:

"The wise investor must remain cautious of novel valuation approaches that stray too far from tried-and-true finance- and economics-based methodologies and frameworks"

With regulatory scrutiny tightening, new FASB standards under Subtopic 350-60 now require measuring certain crypto assets at fair value each reporting period, with changes directly impacting net income. This shift calls for clear valuation policies, thorough pricing reviews, and meticulous documentation to ensure compliance.

For Level 3 assets – such as SAFTs or locked tokens that lack active market data – engaging independent valuation specialists is critical. These professionals offer audit-ready opinions that reduce conflicts of interest and ensure compliance with ASC 820 and IFRS 13 standards. Deloitte highlights the importance of this preparation:

"Being prepared and consistent in valuation operations is essential for maintaining investor confidence"

To stay ahead in this evolving landscape, aligning operational practices with robust regulatory frameworks is essential. Charter Group Fund Administration (https://chartergroupadmin.com) specializes in NAV calculations, compliance support, and blockchain asset valuation. With 79% of fund Boards now reviewing price challenge information at every meeting, partnering with experienced administrators who understand the intricacies of digital assets can simplify operations and strengthen governance structures.

FAQs

What are the key methods for valuing digital assets, and how do you decide which one to use?

When it comes to valuing digital assets, there are three primary methods, each tailored to different circumstances:

- Market Price (Level 1): This method applies to tokens actively traded on liquid exchanges with clear and transparent pricing, such as Bitcoin or Ethereum. The valuation is straightforward – multiply the observable market price by the quantity of tokens held. It’s simple and considered the most dependable approach.

- Comparable Market Data (Level 2): If direct market prices aren’t available, analysts turn to data from similar assets or recent transactions to estimate value. This approach is particularly useful for newer tokens or tokenized securities that lack a robust trading history.

- Model-Based Valuation (Level 3): For assets that are illiquid or still emerging – like early-stage tokens, NFTs, or those with potential future cash flows – valuation depends on financial models. These might include discounted cash flow methods for revenue-generating tokens or cost-based models for projects still under development.

Experts typically start with the most reliable data, using market prices when available. If those aren’t an option, they move to comparable market data, and finally, they rely on models for assets that are more complex or less liquid.

How do fragmented exchanges and low liquidity affect the valuation of digital assets?

Fragmented exchanges and low liquidity make it tough to pin down a consistent market price for digital assets. When tokens are traded on multiple platforms, each exchange might show slightly different prices. These discrepancies can complicate valuations, especially when combined with wider bid-ask spreads and low trading volumes. The result? Greater uncertainty and an increased risk of price manipulation.

A lot of crypto assets fall into the Level 3 (illiquid) assets category. This means their valuation depends heavily on assumptions – like discounted cash flow models or expert judgment – because there’s limited observable market data to rely on. This dependence on unobservable inputs raises the chances of mispricing and creates a wider range of potential fair values.

Charter Group Fund Administration steps in to help hedge funds and boutique investment firms tackle these challenges. They specialize in delivering accurate NAV calculations and compliance support. With a solid background in offshore jurisdictions like the Cayman Islands, Charter Group ensures valuation practices that are both consistent and defensible, even in fragmented and illiquid markets.

How is AI transforming the valuation of digital assets?

Artificial intelligence is transforming how digital assets are valued by handling massive, intricate data sets with unmatched speed and accuracy. AI-powered models analyze a range of inputs in real time – such as on-chain transaction data, market prices, social media sentiment, and economic indicators – uncovering patterns and insights that would take humans far longer to identify. This allows for more precise and timely fair-value assessments, which is especially critical for challenging-to-value assets like Level 3 instruments.

AI also takes predictive analytics to the next level, forecasting price trends, liquidity shifts, and potential risks. With machine learning, these models evolve and improve as fresh data is introduced, ensuring their accuracy aligns with fair-value measurement standards like ASC 820. Charter Group Fund Administration incorporates AI into its valuation and reporting workflows, offering dependable, data-driven asset valuations that comply with U.S. regulations while providing valuable support to fund managers and investors.