The Cayman Islands is a global hub for fund management, offering a stable currency system, tax neutrality, and unrestricted capital flows. Its currency, the Cayman Islands Dollar (KYD), is pegged to the US Dollar at 1 KYD = $1.20 USD, ensuring financial stability and eliminating currency risk for fund managers. The dual-currency economy allows seamless use of both KYD and USD, supported by strong foreign reserves.

Key updates fund managers should note:

- No Capital or Currency Controls: Funds can move money freely across borders without restrictions or delays.

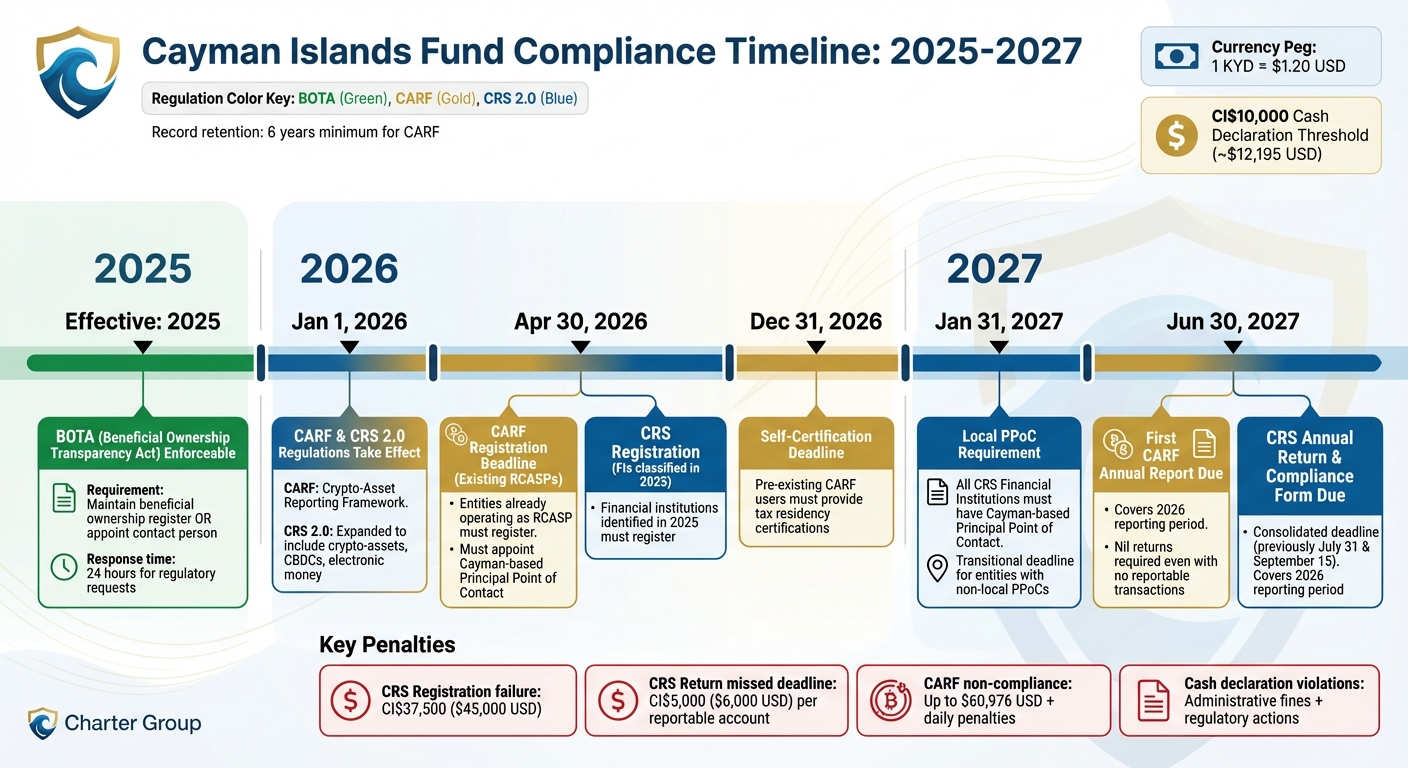

- Upcoming Regulations: Starting January 1, 2026, the Crypto-Asset Reporting Framework (CARF) and CRS 2.0 will impose new reporting requirements, especially for digital asset transactions.

- Compliance Deadlines: CARF registration for existing entities is due by April 30, 2026, with the first annual report due June 30, 2027. CRS 2.0 expands to include crypto-assets and accelerates reporting timelines.

- Beneficial Ownership Transparency Act (BOTA): Effective since 2025, funds must maintain a beneficial ownership register or appoint a contact person for quick regulatory responses.

- Cash Declaration Rules: Cash or negotiable instruments over CI$10,000 (~$12,195 USD) must be declared upon entry.

With stringent compliance measures and penalties, fund managers must stay informed and prepared for these changes to maintain smooth operations in the Cayman Islands.

Cayman Islands Fund Compliance Timeline: Key Deadlines for CARF, CRS 2.0, and BOTA (2025-2027)

No Capital or Currency Controls in the Cayman Islands

The Cayman Islands offers complete freedom from capital and currency controls, allowing fund managers to move money in and out of the jurisdiction without any restrictions, approvals, or delays. This open policy creates a smooth pathway for international capital flows, making the Cayman Islands a prime location for the 13,119 regulated mutual funds and 17,741 registered private funds operating there as of September 30, 2025.

Unrestricted Cross-Border Currency Transfers

This unrestricted approach significantly boosts transaction efficiency. Investors can carry out transactions – whether redeeming their positions or subscribing to funds – without encountering currency conversion hassles or regulatory barriers. For instance, a Tokyo-based investor redeeming their holdings or a New York pension fund subscribing to a new fund can do so seamlessly, without extra steps or delays.

"Legislation imposes no restrictions on the types of activity that may be undertaken by a Cayman Islands investment fund or the types of investments it may make." – Maples Group

Adding to this ease, the absence of withholding taxes simplifies fund operations. Fund managers can distribute returns globally without worrying about tax deductions or complex currency reporting. Whether distributing profits to investors in the US, Europe, or Asia, funds can ensure that investors receive their full returns without any local tax interference.

Advantages for Offshore Fund Structuring

The lack of currency restrictions also encourages creative offshore fund structuring. This flexibility supports strategies like master-feeder structures and allows funds to explore diverse investment opportunities, from private debt to digital assets, all without currency conversion barriers. For example, a fund manager can pool investments from US pension funds, Japanese insurance companies, and European family offices into a single vehicle with ease.

Moreover, fund managers enjoy complete freedom when structuring compensation or profit-sharing arrangements. Marketing intermediaries can also earn commissions without facing legal hurdles.

This flexibility extends to fund financing as well. The Cayman Islands’ creditor-friendly environment and recognition of both local and foreign security packages make it ideal for tools like subscription lines and NAV-based facilities. Private equity funds, in particular, leverage these mechanisms to streamline capital raising, benefiting from the jurisdiction’s open policies that ensure the smooth movement of funds.

CARF Regulations Effective January 2026

Starting January 1, 2026, the Cayman Islands will introduce the Crypto-Asset Reporting Framework (CARF), a global standard developed by the OECD and G20 to enhance tax transparency for digital assets. This framework bolsters the Cayman Islands’ reputation for regulatory clarity and unrestricted capital movement, complementing its existing currency policies. CARF addresses reporting gaps that the Common Reporting Standard (CRS) doesn’t fully cover, particularly in areas like decentralized exchanges, peer-to-peer transactions, and privacy coins.

This step forward in crypto-asset regulation reflects the Cayman Islands’ dedication to efficient fund operations. The regulations specifically apply to Reporting Crypto-Asset Service Providers (RCASPs) – entities facilitating exchange transactions for customers, whether acting as a counterparty, intermediary, or platform provider. By adopting CARF, the Cayman Islands now joins a group of 75 jurisdictions committed to this framework, up from the original 48.

"CARF addresses gaps and challenges posed by such crypto assets as decentralised exchanges, peer-to-peer transactions, and privacy coins, which are not covered by the Common Reporting Standard (CRS)."

Traditional investment funds remain outside CARF’s scope, as merely investing in crypto-assets doesn’t involve exchange transactions, according to OECD Commentary. However, fund managers and investment entities actively managing crypto-assets may fall under the updated definition of a Financial Institution outlined in CRS 2.0, which also becomes effective on January 1, 2026.

What CARF Requires from Fund Managers

RCASPs must report "Relevant Transactions" to the Department for International Tax Cooperation. This includes exchanges between crypto-assets and fiat currencies, exchanges between different crypto-assets, and certain transfers. Retail payment transactions exceeding $50,000, along with airdrops, staking income, and crypto loans, are all considered reportable activities.

The first annual report, covering the 2026 period, is due by June 30, 2027. Even if an RCASP has no reportable users or transactions, a nil return must still be submitted by this deadline. Additionally, all related documentation must be retained for at least six years.

"The CARF requires reporting crypto-asset service providers (RCASPs) with the relevant jurisdictional nexus to report user and transaction information to tax authorities for the automatic exchange of tax information… on an annual basis."

- Department for International Tax Cooperation

In addition to transaction reporting, RCASPs must ensure proper client documentation. This includes obtaining self-certifications from all users to establish their tax residency. New users must provide these certifications starting January 1, 2026, while pre-existing users have until December 31, 2026, to comply. Non-compliance can lead to penalties of up to $60,976 (CI$50,000), with additional daily fines for continued violations.

How to Prepare for CARF Compliance

Fund managers should begin by assessing whether their activities classify them as RCASPs under CARF or as Financial Institutions under CRS 2.0. Some entities may fall under both frameworks, making accurate classification critical.

| Requirement | Deadline |

|---|---|

| CARF Regulations Effective Date | January 1, 2026 |

| Registration (Existing RCASPs) | April 30, 2026 |

| Self-Certification (Pre-existing Users) | December 31, 2026 |

| First Annual Reporting Deadline | June 30, 2027 |

Entities identified as RCASPs must register by April 30, 2026. Those qualifying as RCASPs after the effective date must register by January 31 of the following year. Additionally, each RCASP is required to appoint a Principal Point of Contact based in the Cayman Islands.

To ensure compliance, onboarding systems should be updated to capture CARF-required data for new accounts. Self-certifications must be verified against existing AML/KYC records, and formal policies and procedures should be implemented to manage CARF due diligence and reporting processes. Upgrading system infrastructures to track detailed transaction data will also be key to meeting the first reporting deadline in mid-2027 while minimizing the risk of penalties.

CRS 2.0 Amendments and Crypto-Asset Inclusion

Starting January 1, 2026, the Cayman Islands will roll out the CRS 2.0 amendments. These updates expand the scope of existing currency policies and align with the Crypto-Asset Reporting Framework (CARF), creating a more robust regulatory structure. Notably, CRS 2.0 now classifies crypto-assets, central bank digital currencies (CBDCs), and electronic money as "Financial Assets". The definition of "Investment Entity" has also been broadened to include funds and managers involved in investing, administering, or managing crypto-assets on behalf of clients. This means businesses handling digital wallets, crypto exchanges, or digital asset custody may now fall under the "financial institution" category for CRS purposes.

"CRS 2.0 is intended to sit alongside the OECD’s Crypto-Asset Reporting Framework, or ‘CARF’. CARF will require reporting on crypto transactions, whereas the CRS will require FIs to report holdings of crypto assets."

While CARF focuses on reporting crypto exchange transactions, CRS 2.0 requires financial institutions to disclose account balances and the value of crypto-assets. To prevent redundant reporting, institutions won’t need to report gross proceeds under CRS if those are already covered under CARF.

Changes from CRS to CRS 2.0

The transition to CRS 2.0 brings several operational updates that fund managers must address promptly.

One key change is the acceleration of registration timelines. Entities classified as financial institutions in 2025 must register by April 30, 2026, while new financial institutions in subsequent years must register by January 31 of the following year. Reporting deadlines have also been streamlined, with both the CRS Return and the CRS Compliance Form now due by June 30. This consolidated deadline replaces the previous dates of July 31 and September 15, starting with the 2026 reporting period (filings due by June 30, 2027).

A notable new requirement mandates that the Principal Point of Contact (PPoC) for financial institutions in the Cayman Islands must reside locally. Institutions with non-local PPoCs have until January 31, 2027, to appoint a Cayman-based representative and submit a change form to the Department for International Tax Cooperation (DITC).

| Feature | Previous CRS Framework | CRS 2.0 (Effective 2026) |

|---|---|---|

| Registration Deadline | April 30 | January 31 |

| Reporting Deadline | July 31 (Return) / Sept 15 (Compliance) | June 30 (Both) |

| PPoC Location | Any jurisdiction | Cayman Islands only |

| Asset Scope | Traditional financial assets | Includes crypto-assets, CBDCs, and electronic money |

In addition to these changes, fund managers must meet enhanced data quality standards. This includes providing a declaration that all reported information is complete, accurate, and up-to-date. According to Loeb Smith Attorneys, "adequate" information includes all required details, "accurate" means the data is reliable, and "current" reflects any recent changes in circumstances.

How CRS 2.0 Affects Fund Reporting

Fund managers face new data collection and reporting requirements under CRS 2.0. These include identifying the roles of controlling persons, whether an account is "New" or "Pre-existing", and the type of account (e.g., joint accounts). All this information must be stored in an electronically searchable format to comply with the 2026 reporting standards.

Self-certification forms and account-opening procedures will also need updates to capture these new data points. Managers must ensure valid self-certifications are obtained before or at the time of account opening.

The Tax Information Authority (TIA) has introduced stricter enforcement measures. Under the revised rules, the TIA can impose penalties immediately for missed deadlines without issuing a prior notice of breach. Non-compliance penalties are capped at $60,976 (CI$50,000).

For fund managers using non-Cayman administrators for CRS services, it’s essential to appoint a Cayman-based PPoC by the January 31, 2027 deadline. Additionally, any updates to a financial institution’s registration details – such as name, classification, or PPoC – must be reported to the DITC Portal within 30 days.

"Reporting FIs will need to update their internal processes or liaise with any CRS service providers to ensure processes are adequately reviewed and updated to take account of these new rules."

Cash Import Declaration Requirements Above CI$10,000

Travelers and businesses entering the Cayman Islands with large sums of cash or financial instruments must adhere to strict declaration rules. While the Cayman Islands does not impose general capital controls, these requirements are a key part of the territory’s anti-money laundering framework. Fund managers, in particular, need to be well-versed in these regulations to ensure compliance when dealing with substantial cash movements.

Cash Declaration Rules Explained

Under the Anti-Money Laundering (Amendment) Regulations, 2024, the threshold for declaring cash and financial instruments has been lowered from CI$15,000 to CI$10,000 (approximately $12,195 USD). This means that anyone entering the Cayman Islands with cash or negotiable instruments exceeding this amount must file a Customs Declaration Form (C75).

The declaration requirement covers a range of items, including physical currency, bearer bonds, traveler’s checks, and other negotiable instruments. Additional documentation is required for unaccompanied goods or cash shipments.

Fund managers have additional responsibilities, such as conducting thorough Know-Your-Client (KYC) and Client Due Diligence (CDD) checks to verify the sources of funds and wealth. To assist with this, the Cayman Islands Monetary Authority (CIMA) provides "Declaration of Source of Wealth & Source of Funds" forms, which help document the origins of large sums. For regulated funds, transparency is enhanced by segregating and separately accounting for assets during large transactions.

How to Avoid Penalties

Failing to comply with declaration requirements can result in administrative fines and regulatory actions. CIMA has the authority to issue "cease and desist" orders to unauthorized individuals and compliance directives to authorized entities.

Fund managers should work closely with their administrators to ensure all necessary documentation is in place and that anti-money laundering (AML) and counter-financing of terrorism (CFT) protocols are followed. For private funds, custodians or appointed individuals must verify that the fund retains ownership of any assets being moved. Additionally, all declaration records must be kept in compliance with CIMA’s "Nature, Accessibility, and Retention of Records" guidance, ensuring they are available for regulatory review. Engaging regulated asset safekeeping service providers can further bolster compliance efforts.

sbb-itb-9792f40

Fund Compliance and Reporting Requirements

The Cayman Islands does not impose capital or currency controls, but fund managers must adhere to international standards for tax transparency and anti-money laundering. With CARF and CRS 2.0 set to take effect on January 1, 2026, compliance requirements are becoming more demanding – especially for funds managing digital assets or serving global investors.

Staying Compliant with New Regulations

Fund managers face tight deadlines and hefty penalties for non-compliance. For example, failing to register under CRS can result in a fine of CI$37,500 ($45,000 USD), while missing a CRS return deadline incurs a penalty of CI$5,000 ($6,000 USD) per reportable account. CARF-related violations are outlined in the table below.

All funds registered with CIMA must complete an annual audit by a CIMA-approved auditor, conduct asset valuations, and submit accounts within six months of the year-end. Additionally, governing bodies are required to convene annually to review these results and confirm CRS compliance.

Starting January 1, 2026, all Cayman Financial Institutions must appoint a Principal Point of Contact (PPoC) who is physically based in the Cayman Islands. For funds with administrators located abroad, it will be necessary to designate a local contact before the January 31, 2027 transitional deadline. Furthermore, funds must assign managerial-level personnel to the roles of AMLCO, MLRO, and Deputy MLRO.

Under the Beneficial Ownership Transparency Act (BOTA) 2023, funds must either maintain a Beneficial Ownership Register or appoint a "Contact Person", typically a CIMA-licensed fund administrator. This person must provide beneficial ownership details to authorities within 24 hours of a request. This requirement became enforceable in January 2025, so fund managers should act quickly to ensure compliance.

To keep up with these obligations, fund managers need to adopt efficient and streamlined reporting practices.

Best Practices for Efficient Reporting

Effective reporting is crucial for meeting these stringent requirements. The Cayman Islands has adjusted its reporting timelines. Beginning with the 2026 financial period, the CRS annual return and CRS Compliance Form will both be due by June 30, 2027 – earlier than the previous deadlines of July 31 and September 15. For entities that become Financial Institutions in 2026, the registration deadline has shifted to January 31 of the following year, instead of April 30.

Fund managers should revise investor self-certification forms to collect the additional information required under CRS 2.0 and CARF. This includes data related to crypto-assets, electronic money products, and Central Bank Digital Currencies (CBDCs). All reported information must be accurate, up-to-date, and supported by a formal declaration from the Financial Institution. Valid self-certifications must be obtained at or before account opening, with only limited exceptions.

Most CIMA-regulated filings, such as Fund Annual Returns (FAR) and audited financial statements, must be submitted electronically via the Regulatory Enhanced Electronic Forms Submission (REEFS) platform. While reporting tasks can be delegated to service providers, the fund operator remains legally accountable for the accuracy and completeness of all filings. Establishing clear communication between investment managers, administrators, and the fund’s AML Officers is essential to ensure timely and thorough AML reporting.

Records related to CARF reporting and due diligence must be kept for at least six years. Conducting a gap analysis of current AML and tax reporting processes can help ensure compliance, especially when outsourcing tasks to foreign jurisdictions. Including a review of regulatory compliance as a standing agenda item during annual governing body meetings can further strengthen oversight.

| Regulation | Key Deadline (Effective 2026/2027) | Penalty for Non-Compliance |

|---|---|---|

| CRS Registration (new FIs) | January 31 (year following launch) | CI$37,500 ($45,000 USD) |

| CRS Annual Return & Compliance Form | June 30 | CI$5,000 ($6,000 USD) per reportable account |

| CARF Registration (existing RCASPs) | April 30, 2026 | Up to $60,976 USD |

| CARF Annual Return | June 30 | Up to $60,976 USD plus daily penalties |

| Audited Accounts & FAR | Within 6 months of year-end | CI$20,000 ($24,390 USD) |

| Material Change Notice | 21 days from the change | CI$20,000 ($24,390 USD) |

Charter Group Fund Administration Compliance Support

As regulations in the Cayman Islands grow more stringent, fund managers face increasing challenges in staying compliant. This is where specialized assistance becomes essential.

Services for Cayman Islands Fund Managers

Charter Group Fund Administration provides tailored services to help fund managers meet the compliance demands specific to the Cayman Islands. With 68 licensed administrators overseeing more than 30,000 funds, the firm plays a key role in the region. It also fulfills the principal office requirement for Administered Mutual Funds, which is mandatory for funds with over 15 investors.

Under the Beneficial Ownership Transparency Act (BOTA) 2023, Charter Group acts as the official "contact person" for funds registered with the Cayman Islands Monetary Authority (CIMA). This ensures fund managers can meet the 24-hour response window for requests related to beneficial ownership information.

The firm incorporates established protocols for AML (Anti-Money Laundering), KYC (Know Your Customer), FATCA, and CRS into its services, supporting the Cayman Islands’ tax-neutral status. Charter Group also handles the filing of audited financial statements and annual returns with CIMA, ensuring all submissions meet the six-month deadline following the fiscal year-end. These filings are reviewed and signed off by approved local auditors. For funds dealing with digital assets, the firm navigates the Virtual Asset (Service Providers) Act and the 2025 updates related to tokenized equity interests.

This comprehensive support is bolstered by cutting-edge technology that simplifies compliance processes.

Automated Platforms for Compliance and Reporting

Charter Group’s automation platform is designed to manage the increasingly complex requirements of fund administration. It integrates seamlessly with CIMA’s REEFS (Regulatory Enhanced Electronic Forms Submission) platform for regulatory filings, as well as the AEOI Portal for FATCA and CRS reporting.

The platform ensures compliance with CIMA’s record retention standards, including maintaining identification codes for securities traded by private funds. Additionally, Charter Group offers a secure investor portal that provides real-time NAV (Net Asset Value) calculations, compliance reporting, and fee tracking. These features make it easier for fund managers to stay on top of their obligations while focusing on their core operations.

Conclusion

The Cayman Islands continues to stand out as a top-tier destination for fund structuring, offering unmatched flexibility and convenience. With no capital or currency controls and a fixed peg to the US Dollar, fund managers enjoy the freedom to move capital across borders without restrictions. On top of that, the jurisdiction provides complete tax neutrality – meaning no capital gains, income, profits, or withholding taxes.

That said, this freedom comes with its share of responsibilities. New compliance requirements are on the horizon: CARF takes effect in January 2026, and CRS 2.0 now extends to crypto-assets, necessitating immediate system updates. Additionally, the Beneficial Ownership Transparency Act (BOTA), effective since July 31, 2024, mandates that funds either maintain a beneficial ownership register or designate a CIMA-licensed contact person capable of providing ownership details within 24 hours. This combination of operational flexibility and stringent compliance obligations solidifies the Cayman Islands’ unique standing in global fund structuring.

Timely action is key – appoint a CIMA-approved local auditor without delay, as audited financial statements must be submitted within six months of the fiscal year-end.

As Graeme Loarridge of Ogier aptly puts it:

"The Cayman Islands now represents a gold standard internationally, in terms of regulatory compliance and service provider sophistication".

This reputation hinges on fund managers staying proactive with regulatory updates while optimizing operations through robust systems and reliable partnerships.

FAQs

How will the new CARF and CRS 2.0 regulations affect fund managers handling digital assets?

The Crypto-Asset Reporting Framework (CARF) now mandates that fund managers operating as crypto-asset service providers register with the Cayman tax authority. They are required to gather detailed information about users and transactions and submit annual reports. This framework is designed to boost transparency and ensure greater accountability in managing digital assets.

Meanwhile, CRS 2.0 broadens the scope of the Common Reporting Standard (CRS) to include digital asset holdings. It comes with stricter requirements for data quality, earlier registration deadlines, and the need for a designated local principal point of contact. As a result, fund managers must enhance their compliance systems, reporting protocols, and governance processes to meet these updated standards for digital assets.

What advantages do international fund managers gain from the Cayman Islands’ lack of currency and capital controls?

The Cayman Islands stands out as a prime destination for international fund managers due to its lack of currency restrictions and capital controls. This setup ensures the free flow of capital, effortless currency exchanges, and unrestricted repatriation of funds, streamlining cross-border investments.

This regulatory ease not only lowers compliance hurdles but also cuts operational expenses, enabling fund managers to operate on a global scale without facing unnecessary financial roadblocks. It’s one of the core reasons the Cayman Islands remains a top choice for fund administration.

What important compliance deadlines should fund managers in the Cayman Islands be aware of?

Fund managers in the Cayman Islands need to keep several important compliance deadlines on their radar. Filing audited financial statements and the Fund Annual Return is required within six months of the fund’s fiscal year-end. Additionally, funds must register as a Cayman financial institution with the DITC by January 31 of the following year – a shift from the previous deadline of April 30. Any updates to registered details must also be reported within 21 days of the change.

Staying compliant also means meeting annual reporting obligations under FATCA and CRS. Accurate and timely submissions are essential to avoid regulatory issues.