Form 5500 is an annual filing required for most private-sector employee benefit plans governed by ERISA, including retirement and welfare plans. It provides a detailed report on a plan’s financial health, operations, and compliance. Missing deadlines or submitting incorrect filings can result in penalties of up to $2,586 per day by the Department of Labor (DOL) and $25 per day (up to $15,000) by the IRS. Here’s what you need to know:

- Who Must File: Most retirement and welfare benefit plans, including 401(k) plans and health insurance plans, must file annually. Exceptions include small welfare plans (fewer than 100 participants if unfunded or fully insured) and government or church plans.

- Key Deadlines: The standard deadline is July 31 for calendar year plans, with a possible extension to October 15 by filing Form 5558.

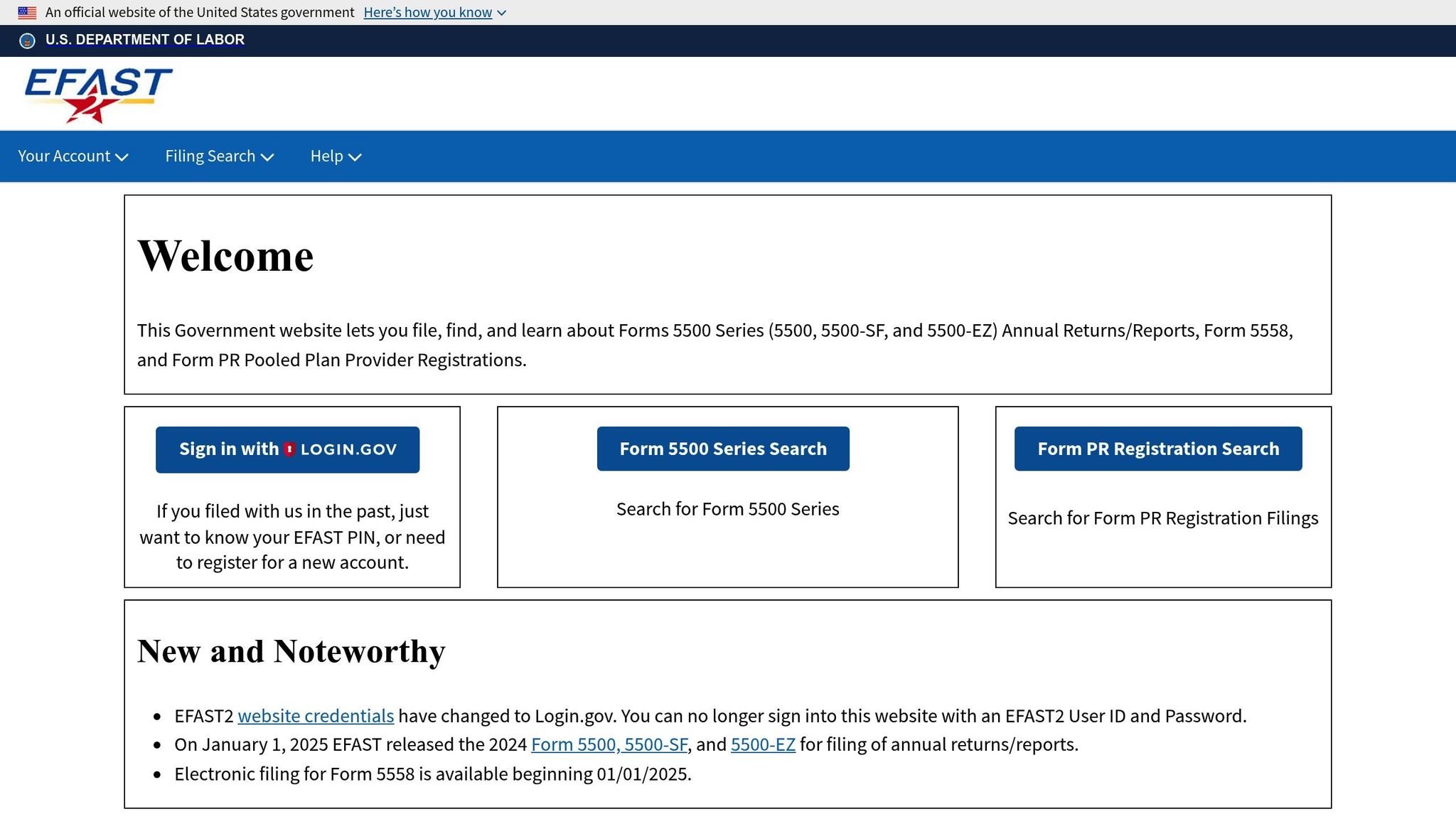

- Filing Process: Submissions must be made electronically via the DOL’s EFAST2 system. Accurate participant counts and required schedules (e.g., Schedule A for insurance plans) are critical.

- Penalties: Late filings can lead to substantial fines. The DOL offers the Delinquent Filer Voluntary Compliance Program (DFVCP) to reduce penalties for late submissions.

Filing accurately and on time not only avoids penalties but also ensures compliance and transparency for participants and regulators. Professional assistance may be beneficial for complex plans or unique reporting needs.

The Form 5500: What All Employers and Plan Administrators Need to Know and How to Avoid Costly Fines

Who Must File Form 5500

Understanding who is required to file Form 5500 depends on the type of plan, the number of participants, and how the plan is funded. Let’s break it down.

Plans That Must File

Retirement plans, such as 401(k) plans, pension plans, profit-sharing plans, and other ERISA-covered retirement benefits, are typically required to file Form 5500 when they meet the minimum participant threshold. For example, a 401(k) plan with 120 participants must file Form 5500.

Welfare benefit plans, which include medical, dental, vision, life insurance, and disability benefits, must file under specific conditions. If the plan is funded through a trust or exceeds the participant threshold, filing is mandatory. Notably, even plans with fewer than 100 participants must file if they are funded through a trust.

Solo 401(k) plans, designed for business owners and their spouses, have their own rules. These plans must file Form 5500-EZ if their assets exceed $250,000 at the end of the year. If the assets fall below this amount, filing isn’t required.

Plans Exempt from Filing

Some plans are not required to file, which helps reduce administrative work.

Government and church plans are exempt. This includes plans sponsored by federal, state, or local governments, as well as those maintained by churches or church-controlled organizations that meet specific IRS criteria.

Small welfare benefit plans can also be exempt if they meet these two conditions:

- Fewer than 100 participants at the start of the plan year.

- The plan is either unfunded (benefits paid directly from the employer’s assets) or fully insured (benefits provided exclusively through insurance contracts without maintaining separate funds).

For instance, a fully insured dental plan with 50 participants or a self-funded medical plan with 80 participants (as long as it doesn’t use a trust) would not need to file.

How to Count Participants

Accurately counting participants is critical since it determines whether you need to file. Mistakes in counting can lead to missed filings and penalties from the IRS and Department of Labor.

Here’s how participants are counted:

- Eligible employees: Count all employees eligible for the plan, even if they’re not actively participating.

- Retirees and beneficiaries: Include these individuals in the count.

- Dependents in welfare plans: Exclude dependents when calculating participant numbers.

The participant count should reflect the number at the beginning of the plan year. Even if the number changes later, the initial count determines filing obligations. For organizations with complex structures, multiple locations, or seasonal workforce changes, working with professional administrators or compliance experts can help ensure accuracy and proper classification.

Filing Requirements and Deadlines

Staying on top of Form 5500 deadlines is crucial for avoiding penalties and maintaining compliance. Knowing when to file, what to include, and the repercussions of missing deadlines can save your organization from hefty fines.

Deadlines and Extensions

The standard deadline for filing Form 5500 is the last day of the seventh month after the plan year ends. For plans that follow a calendar year, this means filing by July 31 of the following year. For non-calendar year plans, the deadline is seven months after the close of the plan year.

If more time is needed, plan sponsors can request a one-time extension of 2.5 months by submitting Form 5558 by the original filing deadline. For calendar year plans, this moves the deadline to October 15. Starting January 1, 2025, Form 5558 can be filed electronically using the EFAST2 system or submitted on paper to the IRS.

Certain situations may qualify for an automatic extension. For example, if the plan year matches the employer’s tax year and the employer has received an extension for their federal income tax return, the Form 5500 deadline is automatically extended. However, this extension is capped at nine and a half months after the plan year ends and cannot be extended further.

Once deadlines are addressed, ensure your filing includes all required schedules.

Required Schedules and Attachments

Filing Form 5500 involves submitting the correct schedules, which depend on your plan type and its details. For instance:

- Defined benefit pension plans must include Schedule SB, completed by an enrolled actuary, to outline the plan’s funding status and future obligations.

- Plans with insurance contracts need to file Schedule A to report insurance-related details.

Additional schedules, such as those covering financial data or service provider information, may also be necessary. Carefully review the latest Form 5500 instructions to confirm which schedules apply to your plan.

Penalties for Late or Missing Filings

Missing the filing deadline can lead to steep penalties. The Department of Labor (DOL) may impose fines of up to $2,586 per day for each late filing. On top of that, the IRS can charge $25 per day, up to a maximum of $15,000 per late filing.

Late or missing filings can also increase the risk of audits and additional expenses. To address such situations, the DOL offers the Delinquent Filer Voluntary Compliance Program (DFVCP). This program allows plan sponsors to resolve late filings while paying reduced penalties. Under the DFVCP, small plans generally face penalties of about $10 per day (capped at $2,000), while large plans have a cap of $4,000.

| Filing Requirement | Standard Deadline | Extension Available | How to Extend | Maximum Penalty (DOL) | Maximum Penalty (IRS) |

|---|---|---|---|---|---|

| Form 5500 (calendar year) | July 31 | Yes (to Oct. 15) | File Form 5558 by 7/31 | $2,586/day | $25/day, up to $15,000 |

Given the complexity of some plans, professional administration can be a valuable resource. Services like Charter Group Fund Administration can help ensure your Form 5500 filings are accurate and submitted on time.

sbb-itb-9792f40

How to File Form 5500: Step-by-Step Guide

Filing Form 5500 electronically through the Department of Labor’s EFAST2 system is required for most plans. The process involves careful preparation, choosing the right form, and following the electronic filing procedures. Here’s a step-by-step guide to help you file accurately and on time.

Gathering Required Information

Before you start, gather all the necessary information. This includes:

- Plan details: The plan’s name, number, year, your employer identification number (EIN), and contact details for the plan administrator.

- Financial records: Financial statements, asset schedules, participant counts, and details on investments and insurance contracts. If your plan operates through a trust, you’ll also need trust-related information.

- Defined benefit plans: Additional actuarial data is required. Schedule SB, completed by an enrolled actuary, must include funding status and future obligations.

Keep supporting documents, like bank statements, investment account records, and participant enrollment data, handy to ensure all reported figures are backed up.

Selecting the Right Form Version

Once your documents are ready, choose the correct form based on your plan type and participant count. The Department of Labor provides three main versions:

- Form 5500: For plans with 100 or more participants or those that don’t qualify for simplified filing. This version requires detailed financial reporting.

- Form 5500-SF: For smaller plans with fewer than 100 participants, provided they meet specific criteria (e.g., no employer securities and assets with easily determined fair market value).

- Form 5500-EZ: For solo 401(k) plans covering only the business owner and their spouse. Filing is required only if assets exceed $250,000 at year-end.

| Form Version | Participant Count | Key Requirements | When Required |

|---|---|---|---|

| Form 5500 | 100+ participants | Comprehensive financial reporting | Annual filing |

| Form 5500-SF | Under 100 | No employer securities; easily valued assets | Annual filing |

| Form 5500-EZ | Solo 401(k) only | Business owner/spouse only; assets > $250,000 | Only if applicable |

Double-check the instructions to confirm eligibility. Filing the wrong form can lead to rejection.

Filing Through the EFAST2 System

With your information and form ready, you’ll need to file electronically through the EFAST2 system. Paper filings are no longer accepted for most plans.

Here’s how to file:

- Register for EFAST2 access: Each signer needs an account and PIN. Authorized signers, such as the plan administrator or their representative, are required to use digital signatures.

- Prepare your form: Use approved software or the Department of Labor’s free IFILE system. IFILE includes built-in error validation to help catch mistakes.

- Upload and validate: Submit your completed form and schedules. Address any validation errors before proceeding.

- Sign electronically: Use your EFAST2 credentials to digitally sign the form. Forms without valid digital signatures will be automatically rejected.

- Submit and confirm: After submitting, you’ll receive a confirmation email with your filing status. This email includes a unique filing identifier, which serves as proof of submission and allows you to track your filing.

Make sure to save all confirmations and supporting documents. The Department of Labor may request these during audits or reviews.

For plans with complex structures or unique investments, professional help can make the process smoother. Services like Charter Group Fund Administration offer tailored compliance support, ensuring your filing is accurate and timely.

Best Practices for Accurate Filing

Accurate filing of Form 5500 requires attention to detail, proper planning, and adherence to deadlines. Each year, the Department of Labor identifies thousands of plans with errors or late submissions, often leading to audits and enforcement actions. By following tried-and-true practices, you can avoid these pitfalls and stay compliant.

Tips for Accurate and Timely Filing

Start early and set reminders. Don’t wait until the last minute – establish internal deadlines well before the official July 31 cutoff. This extra time gives you breathing room to resolve any unexpected issues without rushing.

Use a detailed checklist to confirm accuracy. Double-check participant counts, required schedules, and data entry using multiple sources like payroll and HR records. Common mistakes include incorrect participant numbers, missing attachments, and errors in plan year dates. For participant counts, include all eligible employees (even if they’re not enrolled), former employees, and beneficiaries receiving benefits. However, dependents covered under the plan should not be included.

Leverage EFAST2’s error-checking tools. These built-in features help identify and correct mistakes before submission. Pay attention to system warnings – they’re there to prevent rejections and compliance issues.

Keep records for at least six years. Maintain both digital and physical copies of your filings. This practice not only simplifies audits but also makes future filings smoother.

For added support, consider working with professionals, especially if your plan involves complex structures or investments.

Working with Professional Support

Filing Form 5500 can become especially challenging when dealing with intricate plan structures, offshore jurisdictions, or specialized investments. In these cases, professional fund administration services can be invaluable. They provide expertise in compliance, data management, and regulatory requirements, helping to reduce errors and avoid missed deadlines.

For example, plans with complex investments like hedge funds or crypto funds often require specialized assistance. Firms such as Charter Group Fund Administration offer services tailored to these needs, including accounting, NAV calculations, and regulatory compliance (AML, CRS, FATCA). Their expertise in offshore jurisdictions like the Cayman Islands ensures accurate reporting and adherence to multiple regulatory frameworks.

"Under Brian’s leadership, the service was responsive, timely, and accurate. I highly recommend Brian." – Richard Fish, Director at Bennelong Long Short Equity Management

Professional administrators bring several advantages, including staying updated on regulatory changes, using advanced technology for data management, and providing independent verification of financial metrics. This level of support is particularly critical for plans involving derivatives, international elements, or other specialized reporting needs.

Schedule annual post-filing reviews with your professional team. These reviews help identify areas for improvement, adapt to new regulations, and refine your filing process year after year.

Additional Resources and Tools

In addition to professional support, several tools and resources can simplify the filing process. The IRS Form 5500 Corner offers detailed instructions, updates, and guidance tailored to different plan types. Meanwhile, the DOL’s EFAST2 system provides not only an electronic filing platform but also troubleshooting guides and technical support.

The Troubleshooter’s Guide is another valuable resource, offering practical solutions for common filing errors and explanations of system messages. If you encounter validation errors or need clarification on specific reporting requirements, this guide can save you time and frustration.

FAQs on the DOL and IRS websites address common questions about deadlines, required schedules, and filing procedures. These pages are updated regularly to reflect current regulations, making them a reliable source of information.

If you’ve made a mistake or missed a deadline, the DOL’s Delinquent Filer Voluntary Compliance Program (DFVCP) allows you to self-correct while minimizing penalties. Acting quickly through this program can significantly reduce financial consequences compared to waiting for enforcement action.

Finally, electronic filing options continue to improve. For example, Form 5558 (used to request a filing extension) can now be submitted electronically via EFAST2, making the process more efficient and less reliant on paperwork.

Conclusion

Filing Form 5500 is a key part of managing employee benefit plans effectively. It involves understanding which plans need to file, keeping track of participant counts, and meeting strict deadlines. This process requires attention to detail and careful execution.

The consequences of missing deadlines or filing incorrectly can be serious. Some plans are required to file annually, while others might be exempt. Ensuring timely submissions is essential to avoid penalties from the IRS and the Department of Labor.

Electronic filing through EFAST2, along with updates like the streamlined Form 5558 process starting January 1, 2025, makes compliance more straightforward and efficient. These updates aim to simplify the process for all plan types while maintaining accuracy.

For organizations dealing with more intricate investment structures, professional guidance can make a big difference. Services like Charter Group Fund Administration offer expertise that can help manage filings and ensure compliance with regulatory requirements.

Accurate and timely filing does more than just prevent penalties. It reflects a commitment to fiduciary responsibility, strengthens trust with participants, and fosters smoother interactions with regulators. Companies that prioritize well-organized filing systems often see improvements in the overall efficiency and transparency of their plan administration.

FAQs

What are common mistakes to avoid when filing Form 5500, and how can you prevent them?

Filing Form 5500 can feel overwhelming, especially since even small mistakes can lead to penalties or compliance problems. Common missteps include missing deadlines, submitting incomplete or incorrect information, or forgetting to attach necessary schedules. To avoid these pitfalls, take the time to thoroughly review the filing instructions, verify that all data is accurate, and ensure the form is submitted on time.

If you’re uncertain about any part of the process, seeking guidance from a professional or using fund administration services can simplify the task and help minimize the chance of errors.

What is the Delinquent Filer Voluntary Compliance Program (DFVCP), and how can it help reduce penalties for late Form 5500 filings?

The Department of Labor (DOL) created the Delinquent Filer Voluntary Compliance Program (DFVCP) to help plan administrators resolve late or missing Form 5500 filings. This program offers a way to address compliance issues while significantly lowering the penalties tied to overdue submissions.

Here’s how it works: Eligible plan administrators must file the overdue Form 5500 and pay a reduced penalty fee. The penalty amount depends on how many filings are late and how long they’ve been delayed. However, the program includes a cap on penalties, making it easier for organizations to bring themselves back into compliance without facing overwhelming costs. It’s a practical solution for those who’ve missed deadlines but want to correct the situation and limit financial repercussions.

How can I accurately determine participant counts for Form 5500 filing?

Accurately figuring out the number of participants for Form 5500 filing means taking a close look at your employee benefit plan records to ensure no one eligible is left out. Participants include current employees contributing to the plan, former employees who still have account balances, and beneficiaries receiving benefits.

Here’s how to stay accurate:

- Double-check enrollment and eligibility records to make sure all active participants are accounted for.

- Review records for former employees who still have balances in the plan.

- Leave out individuals who no longer have account balances or don’t qualify anymore.

Getting these numbers right is essential for staying compliant and avoiding filing mistakes or penalties.